Capital protected Bitcoin ETF products are revolutionizing how European investors access cryptocurrency markets right now. UniCredit has partnered with BlackRock to offer a structured investment linked to the iShares Bitcoin Trust, and this provides Bitcoin exposure with downside protection for risk-averse clients.

Also Read: Ethereum: BlackRock Buys 48% More ETH Amid 7% Dip, Signs Big Confidence

How Capital Protected Bitcoin ETF from UniCredit and BlackRock Limits Crypto Risks

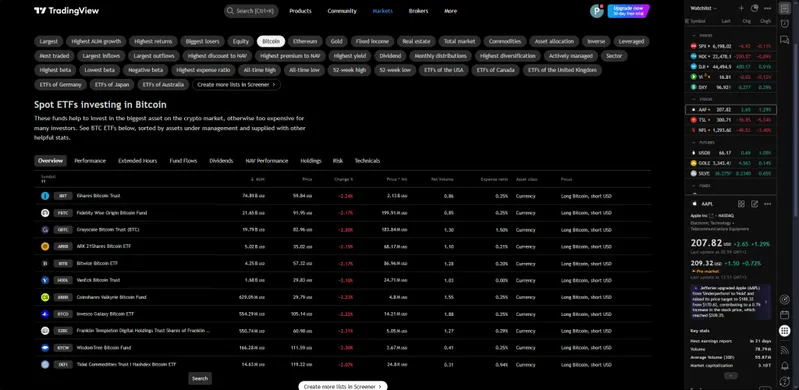

The new capital protected Bitcoin ETF offering addresses major investor concerns about cryptocurrency volatility, and it’s particularly relevant at the time of writing. UniCredit’s structured product tracks BlackRock’s iShares Bitcoin Trust (IBIT) while also guaranteeing principal protection at maturity.

This BlackRock Bitcoin ETF linked product targets private banking clients who want Bitcoin exposure without the full downside risk. The capital protection mechanism ensures that investors receive their initial investment back regardless of Bitcoin price movements.

Product Features and Structure

UniCredit Bitcoin investment products use structured notes to provide 100% capital protection, and they also allow participation in upside gains. Investors participate in Bitcoin’s upside potential through the BlackRock Bitcoin ETF while being shielded from losses at the same time.

The Bitcoin ETF with capital protection appeals to institutional investors seeking controlled cryptocurrency exposure right now. This approach allows traditional portfolios to include digital assets without compromising risk management principles, and it’s gaining traction.

Also Read: Antitrust Heat on BlackRock, Vanguard & State Street’s $27T Grip

Risk Management Benefits

Crypto investment risk management becomes simplified through capital protected Bitcoin ETF structures, and this is particularly important. UniCredit’s offering demonstrates how banks can provide cryptocurrency access while maintaining regulatory compliance and also client protection.

It uses the BlackRock Bitcoin ETF as the underlying asset and it rides on the good results and the liquidity generated by IBIT. This alliance brings together expertise in ETF BlackRock and structured products UniCredit and comes at a good time.

As at the time of writing, the future of institutional crypto adoption will be Bitcoin ETF with capital protection products. They intersect quite uniquely with the traditional finance-driven into the digital asset space and are among the fastest-growing instruments, which opens an opportunity to invest in cryptocurrencies to risk-averse investors.