UAE’s crypto dollar hedge strategies are actually accelerating right now as the Emirates partners with BRICS+ nations to challenge US financial dominance. The UAE’s sitting on 6,300 Bitcoin worth $700 million through state mining operations. This UAE crypto dollar hedge includes UAE bitcoin holdings for 2025, digital ruble earnings forecast, India BRICS crypto policy, and Saudi US dollar exposure reduction.

UAE’s Crypto Dollar Hedge Shapes Bitcoin, Digital Ruble, India, and Saudi Moves

1. Russia’s Digital Ruble Plans

So here’s the thing – Russia’s digital ruble earnings forecast projects $3.2 billion in annual economic benefits. The digital ruble earnings forecast indicates major businesses could basically gain 30-50 billion rubles yearly. This digital ruble earnings forecast supports the UAE crypto dollar hedge coordination.

Donald Trump urged Russia’s Vladimir Putin and Ukraine’s Volodymyr Zelenskiy to show some “flexibility” as the US president accelerates his efforts to end the war in Ukraine https://t.co/S7n9A3Iq3T

— Bloomberg (@business) August 19, 2025

What’s happening is Russia’s Central Bank plans digital ruble operations by end of year 2025, which pretty much complements the UAE crypto dollar hedge strategy.

War or peace? For oil markets, the Ukraine outcome is insignificant – column by @ronbousso1 https://t.co/KOuiEg4GQq pic.twitter.com/GXfqa81l4s

— Reuters Energy and Commodities (@ReutersCommods) August 19, 2025

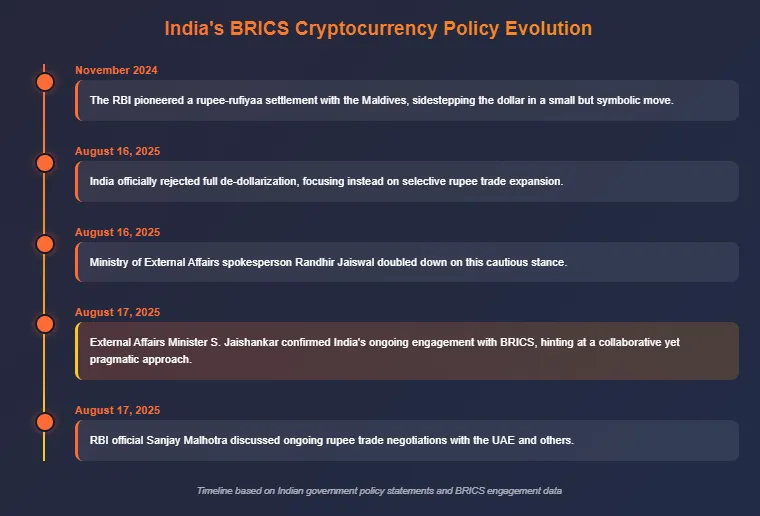

2. India’s BRICS Approach

Now, India’s BRICS crypto policy maintains balance between sovereignty and stability. External Affairs Minister S. Jaishankar stated:

“The dollar as the reserve currency is the source of global economic stability, and right now what we want in the world is more economic stability, not less.”

Regardless, India BRICS crypto policy is to expand rupee trade with the UAE partners, they will hedge their bets. Reserve Bank introduced the rupee settlements, which on a gradual basis has led to India BRICS Communist creation on crypto policy that match with the crypto dollar hedge in the UAE.

3. Saudi’s Dollar Reduction

Saudi US dollar exposure reduction accelerates through currency diversification right now. The thing is, the kingdom moved 30% of oil transactions to non-dollar currencies.

BREAKING: THE UNITED ARAB EMIRATES IS NOW ON ARKHAM

— Arkham (@arkham) August 25, 2025

The UAE’s $700M BTC holdings are now labeled on Arkham. These holdings come from Bitcoin mining operations carried out by Citadel, a public mining company majority owned by UAE Royal Group through IHC.

Arkham is the first to… pic.twitter.com/eIGut5pJXN

Saudi Finance Minister Mohammed al-Jadaan had this to say:

“We will consider trading in currencies other than the US dollar.”

Saudi’s US dollar exposure reduction includes China’s mBridge digital currency platform. This Saudi US dollar exposure reduction complements UAE crypto dollar hedge efforts regionally.

In conjunction with Phoenix Group (a public UAE mining company) and the UAE government-owned IHC, Citadel built an 80,000 square meter bitcoin mining facility on Al Reem Island in Abu Dhabi in 2022 in 6 months.

— Arkham (@arkham) August 25, 2025

We were able to corroborate the timeline of on-chain mining activity… pic.twitter.com/MyTJQRzh7K

Also Read: SCO’s Tianjin Summit: 20+ Nations Embrace 80%+ Ruble-Yuan Trade Shift

The projections of the UAE’s bitcoin holdings in 2025 will also keep increasing as more capital ventures into mining. The UAE bitcoin holdings for 2025 strategy, in my view, simply takes advantage of these Abu Dhabi plants that have been established in employment with Citadel Mining – yet are they really ready to face the fluctuation? These UAE bitcoin holdings 2025-buildups reinforce the UAE crypto dollar hedging structure.