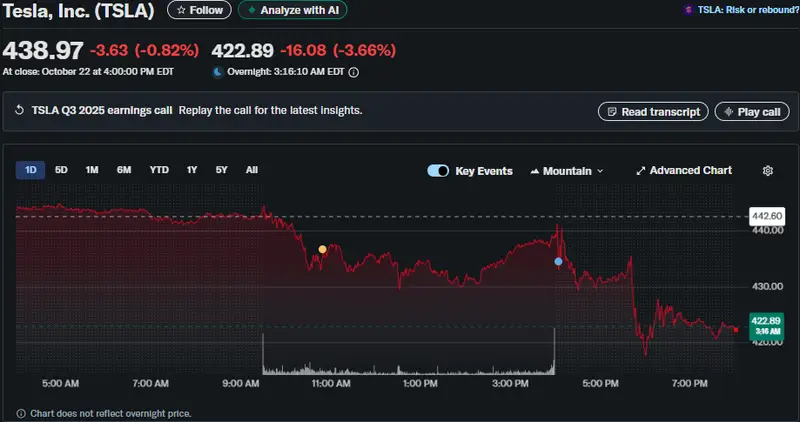

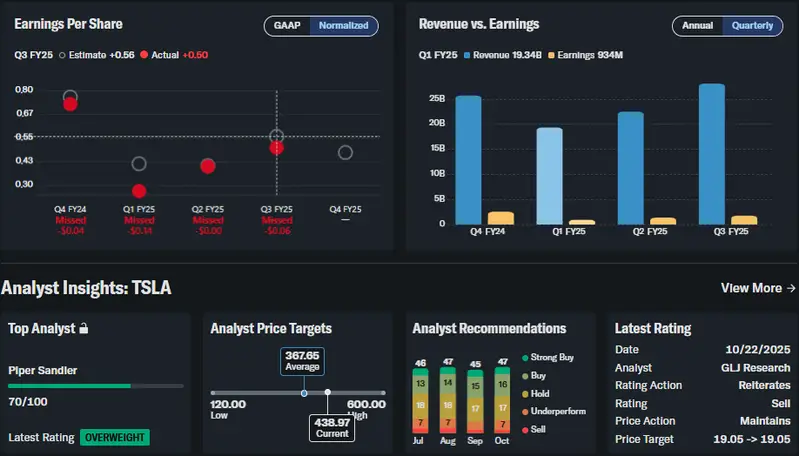

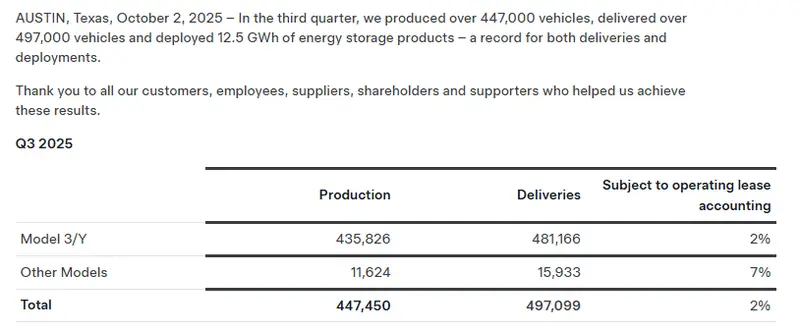

Tesla’s Q3 earnings revealed profit plunged 37% to $1.4 billion from $2.2 billion a year earlier, despite revenue climbing to $28.1 billion. TSLA stock declined after the company earned less per vehicle due to price cuts and low-interest loans. Market share loss accelerated as competitors offered comparable technology at lower prices, and Elon Musk shifted focus toward robotaxi expansion ahead of a crucial shareholder vote.

Tesla Q3 Earnings Miss Sparks TSLA Drop Amid Robotaxi Expansion Plans

Pricing Strategy Sacrifices Margins

Tesla’s Q3 earnings showed the company sold more vehicles than in Q3 2024, but profitability collapsed. The automaker reduced prices and offered low-interest loans to stimulate demand as shoppers rushed to use a federal EV tax credit before it expired September 30. TSLA stock investors reacted negatively to margin compression.

Tesla introduced stripped-down Model 3 and Model Y versions priced at $36,990 and $39,990, cutting around $5,000 from previous entry-level models.

Market Share Loss and Regulatory Headwinds

Tesla Q3 earnings came as clean air credit revenue declined after President Trump and Republicans weakened environmental regulations. These credits had historically boosted profit significantly. TSLA stock weakness also reflected market share loss, dropping to 41% in the U.S. from 48% a year earlier, according to Cox Automotive.

Also Read: Tesla (TSLA) Stock Dips After Facing Yet Another Federal Probe

Robotaxi Expansion Takes Priority

Elon Musk stated:

“We are expecting to have no safety drivers in large parts of Austin by the end of this year… we are being very cautious about the deployment.”

The CEO announced robotaxi expansion testing in 8 to 10 metro areas by December, including Nevada, Florida, and Arizona.

Wedbush analyst Dan Ives had this to say:

“We continue to strongly believe the most important chapter in Tesla’s growth story is now beginning with the AI era now here. It starts with autonomous then robotics as we believe the autonomous valuation is worth $1 trillion alone to the Tesla story over the next few years.”

TSLA stock bulls value future autonomous businesses over current profits. Tesla Q3 earnings arrived before shareholders vote November 6 on Musk’s $1 trillion compensation package.

Also Read: Tesla (TSLA) Gets $490 Price Revision: $500 Before 2025 Ends?