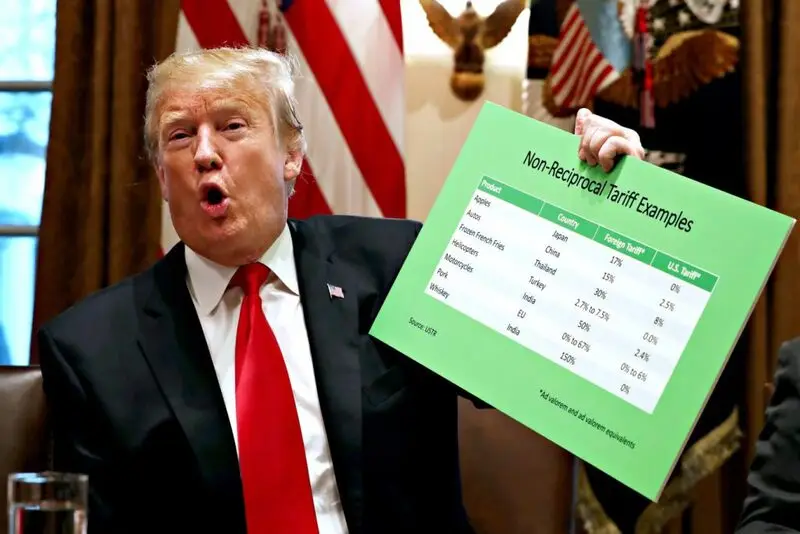

Trump tariffs have sparked market panic, wiping an estimated $6 trillion from global markets as JPMorgan raises recession odds to 60% amid intensifying market volatility. Major indexes worldwide experienced their worst losses since 2020 following the sweeping tariffs announcement last week that has triggered retaliatory measures from major trading partners and warnings of US economic disruption.

Just spoke with @Keir_Starmer and shared my concern over the impact of the US tariffs on the global economy.

— Ursula von der Leyen (@vonderleyen) April 6, 2025

We also discussed security & defence and the upcoming EU-UK Summit.

Read-out ↓

Also Read: Markets Panic: Ackman Pushes Pause on Tariffs to Halt Crash

How Trump’s Tariffs Trigger Market Volatility and Impact the Global Economy

Trump tariffs implementation has created widespread market volatility that threatens global economic stability. Japan’s Nikkei dropped 7.8% and Hong Kong’s Hang Seng plummeted over 12% in a single day, reflecting growing concerns about a potential global recession.

Financial Experts Warn of Recession Risk

JPMorgan Chase dramatically increased its global recession probability from 40% to 60% due to Trump tariffs and new US trade policies.

JPMorgan stated: “Disruptive U.S. policies have been recognized as the biggest risk to the global outlook all year. The effect is likely to be magnified through tariff retaliation, a slide in U.S. business sentiment and supply-chain disruptions.”

HSBC analysts noted: “Our equity market implied recession probability indicator suggests equities are already pricing in about 40% chance of a recession by the end of the year.”

Also Read: Top 3 Cryptocurrencies That Could Recover This Week

Trump Administration Defends Policy

Despite market volatility and US economic disruption fears, Trump defended his tariff policy aboard Air Force One.

President Trump said: “Sometimes you have to take medicine to fix something.”

Treasury Secretary Scott Bessent told NBC’s Meet the Press: “There is no reason to expect a recession as a result. This is an adjustment process.”

Commerce Secretary Howard Lutnick confirmed regarding additional tariffs: “[Trump] announced it and he wasn’t kidding.”

International Response and Market Outlook

China announced a 34% retaliatory tariff on all US imports beginning April 10th in response to Trump tariffs. This escalation has intensified global recession fears and market volatility.

UK Prime Minister Sir Keir Starmer warned: “The world as we knew it has gone.”

Also Read: Ripple: XRP Eyes $7 Despite Market Uncertainty, Here’s How

Several major financial institutions have now cut their market outlooks, and at the moment, Capital Economics has actually set the lowest S&P 500 target at around 5,500. Also, Goldman Sachs currently expects that there will be three interest rate cuts by the end of the year, which they believe might help to counter the US economic disruption that has been caused by the Trump tariffs.

| Brokerages | US recession probability before Trump’s latest tariffs | US recession probability after Trump’s latest tariffs |

|---|---|---|

| J.P.Morgan | 40% | 60% |

| Goldman Sachs | 20% | 35% |

| S&P Global | 25% | 30-35% |

| HSBC | – | 40% |

The 60% global recession probability warning from JPMorgan highlights the serious risks posed by escalating trade tensions. With $6 trillion already wiped from markets and retaliatory measures being implemented by major economies, the Trump tariffs could trigger a prolonged economic crisis unless trade tensions are resolved.