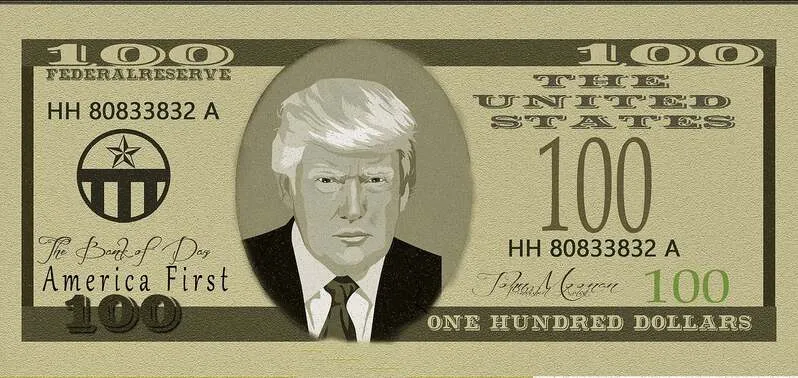

Donald Trump, the 47th president of the United States, is currently inviting heavy scrutiny and criticism. His administration is marred by fierce policies, tariff hikes, and ideas that have taken a significant toll on the US dollar. His blunt comments and opinions have made notable headlines across the markets, eventually hitting the US dollar, with investors pivoting around to figure out stable alternatives other than the weak US dollar. Trump’s policies have certainly weakened the US dollar, but now, his latest move could have changed the USD game forever.

Also Read: Currency News: Chinese Yuan Emerges as Top Threat to US Dollar Power

The President’s Latest Move and Its Effect on the US Dollar

Donald Trump was elected in January 2025 and had assumed duties with great vigor and enthusiasm. Investors celebrated his election with zest, hoping the dollar would eventually gain a significant upswing once Trump officially assumed the reins of administration. However, since the start of his political career as the 47th US president, things have started to go awry significantly.

His election was meant to fix the US dollar’s wobbly stance, but the opposite has happened. The US dollar has now fallen to new levels, with the DXY index touching 96 for the first time in years.

🚨 US Dollar Alert:

— Wall Street Gold (@WSBGold) June 26, 2025

The $USD just slipped below 97 for the first time in months — now hitting a fresh low of 96.94.

Watch the metals… this could light the fuse. 💥📈 pic.twitter.com/7m9tauJKUJ

This notable devaluation comes after Trump’s latest spree of opinions on how he wants to remove Fed Chair Jerome Powell from office. On Wednesday, Trump ended up delivering a few stark opinions about Powell, labeling him a “terrible” person.

“I know three or four people who I’m going to pick. He goes out pretty soon, fortunately, because I think he’s terrible,” said Trump.

Trump is also planning to replace Powell as early as September, eager to announce a new successor in his place.

JUST IN: 🇺🇸 President Trump says he started interviewing candidates to replace Fed Chair Jerome Powell.

pic.twitter.com/LYZMlQJe7m— Watcher.Guru (@WatcherGuru) June 25, 2025

President Donald Trump has long been spiteful towards Powell, stating his unwillingness to cut rates as the primary reason for his angst and rising temper against the Fed chair.

US Dollar Plunges Amid Trump-Powell Clash

Amid the heightened tensions between Donald Trump and Jerome Powell, the markets are showing a rather cautious stance at the moment. The investor sentiment towards the dollar has now changed, with the USD depreciating against its competitors, including the euro, Swiss franc, pound, and yen.

“I think it’s a given that Trump’s pick to succeed Powell. When it comes, will be one that sits at the highly dovish end of the spectrum. And will support Trump’s agenda of lowering interest rates. The issue with this is it will resurface questions from earlier in the year. Around the Fed’s independence. Which, as we saw, undermines confidence in the Fed and the USD.” Tony Sycamore, a market analyst at IG, told Reuters.

Also Read: 2 Countries Pay $50 Billion in Local Currency, Ditch US Dollar