A weaker dollar has emerged as President Trump’s unconventional economic approach right now, and it’s marking a sharp break from decades of US policy as BRICS nations continue to accelerate their efforts to reduce dollar dependence. The currency sits at its weakest level in four years at the time of writing, having dropped nearly 10% in 2025 and another 2% so far in 2026, which represents the sharpest annual decline since 2017.

The weaker dollar Trump has welcomed represents a departure from traditional Republican orthodoxy on currency matters, which has typically favored a strong dollar.

Trump stated on Tuesday when addressing reporters:

“I think it’s great. Look at the business we’re doing. The dollar’s doing great.”

Also Read: Dollar Has Further to Fall While BRICS Builds Parallel System

Weaker Dollar Trump Policy And BRICS De-Dollarization

Trump’s approach to the weaker dollar, however controversial, aligns with growing BRICS de-dollarization efforts that have been gaining momentum across multiple fronts. Russia now conducts around 90% of its intra-BRICS trade in national currencies, and BRICS central banks purchased over 1,100 tons of gold in 2025—the largest increase in seven decades, which signals a major shift in reserve asset preferences.

The US dollar decline has been driven by several factors, including concerns about Trump’s unpredictable approach to economic policy, especially his use of tariffs, as well as his frequent criticisms of the Federal Reserve. The Federal Reserve has been cutting interest rates, lowering them three times in late 2025 before pausing this week, and higher rates generally tend to lead to higher currencies.

How The Weaker Dollar Benefits American Exports

The weaker dollar makes American exports more competitive abroad, which supports domestic manufacturers in a tangible way. When the currency weakens, foreign buyers find US products less expensive, and this potentially boosts sales and employment in manufacturing sectors across the country. American companies with significant sales abroad, also, can benefit when converting their profits earned in foreign currencies back into US dollars.

The domestic tourism industry also gets a boost from a weaker dollar. It makes the country more attractive to foreign visitors, since their own currency buys them more dollars to use on vacation spending, which helps hotels, restaurants, and other tourism-related businesses.

Treasury Secretary Scott Bessent attempted to clarify the administration’s position on Wednesday, and he was quoted as stating:

“The US always has a strong dollar policy. But a strong dollar policy means setting the right fundamentals. If we have sound policies, the money will flow in.”

Bessent made his remarks just a day after Trump made his comments, and markets interpreted them as an attempt to reassure investors about the administration’s commitment to the strong dollar policy that the US has maintained as a cornerstone of its economic approach for decades.

BRICS Nations Push Alternative Payment Systems

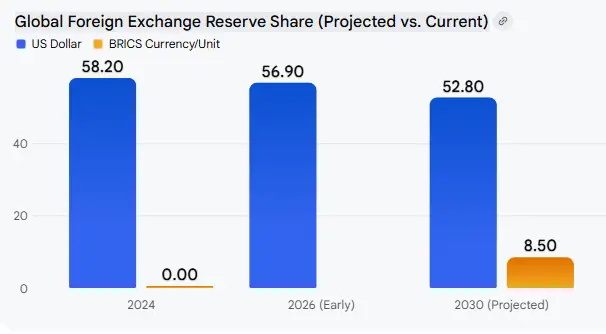

BRICS will launch BRICS Pay by the end of 2026, and the system will connect member nations’ central bank digital currencies to bypass Western payment systems like SWIFT. The bloc has reduced its official dollar reserves to 56.92% by January 2026, down from previous levels, which shows a clear trend of BRICS de-dollarization taking shape.

The timing of these BRICS de-dollarization initiatives coincides with the weaker dollar environment, raising questions about whether the currency’s decline is accelerating the shift away from dollar-based trade systems.

The New Development Bank, also, has set a target of conducting 30% of its lending in local currencies by late 2026 to reduce reliance on the US dollar. China’s currency swap arrangement with Brazil now covers nearly 30% of their bilateral trade, and this demonstrates how alternative financial mechanisms are being implemented in practice.

Russian President Vladimir Putin had this to say about the situation:

“We are not refusing, not fighting the dollar, but if they don’t let us work with it, what can we do? We then have to look for other alternatives, which is happening.”

India’s External Affairs Minister S. Jaishankar, however, offered a different perspective when he stated:

“I do not believe we have any policy to have a replacement to the dollar. Global economic stability is pegged on the dollar as the reserve currency, and currently, the last thing we want in our world is less economic stability.”

The Risks Of A Weaker Dollar

The drawbacks of the US dollar decline are being felt by American consumers and businesses alike, and they’re significant. Imported goods become more expensive, which contributes to inflationary pressures that affect both shoppers and manufacturers who need foreign parts and raw materials. The euro has strengthened about 13% against the dollar over the past year, making European travel notably more costly for Americans right now.

Economists and market observers have traditionally viewed a country’s currency as a reflection of its global economic standing, and analysts often interpret sharp currency declines as signals of eroding confidence in that nation’s economic fundamentals. These concerns about the dollar losing global dominance drove what traders called the “Sell America” trade that emerged in 2025, though foreign investors haven’t abandoned US assets as extensively as analysts initially feared.

The administration’s embrace of a weaker dollar, also, represents a fundamental tension between supporting domestic industry through competitive currency valuation and maintaining the dollar’s status as the world’s reserve currency. Trump’s stance on the weaker dollar has raised questions about long-term implications. In late 2025, the administration threatened 100% tariffs on BRICS nations if they actively pursued replacing the dollar with a unified bloc currency, which shows the geopolitical stakes involved.

Long-Term Implications For Global Currency Markets

Bessent defended the administration’s economic policies and said that shrinking US trade deficits should automatically lead to more dollar strength over time. His comments suggest the Treasury Department is defining a strong dollar policy not by the currency’s exchange rate alone, but by economic fundamentals that attract capital flows into American markets.

Also Read: BRICS Member Snubs America’s Drone Deal

As BRICS nations continue building alternatives to dollar-based systems—including the mBridge blockchain platform for wholesale central bank digital currency exchanges—the ongoing BRICS de-dollarization movement represents a significant challenge to American economic influence that has existed since World War II ended. BRICS de-dollarization efforts have picked up pace in recent months, with member nations testing multiple payment systems and currency arrangements. Whether a weaker dollar truly benefits America, or whether the dollar losing global dominance will justify these concerns, only time will tell as these parallel trends continue to develop throughout 2026.