Trump EU tariffs have sent shockwaves through the cryptocurrency market, triggering unprecedented Bitcoin price drops and market volatility across the crypto landscape. The surprise announcement of potential 25% tariffs against the European Union has pushed Bitcoin below $85,000 for the first time since early November.

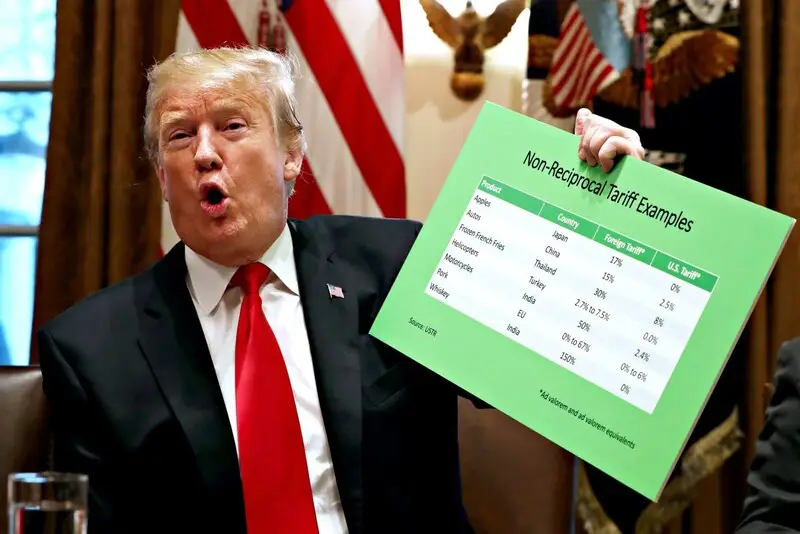

“We have made a decision and we’ll be announcing it very soon. It’ll be 25 per cent generally speaking, and that will be on cars and all other things,” Trump said during his first Cabinet meeting.

Also Read: Forget the BTC Crash: Here’s What Went ‘Right’ for Crypto in 2025

Understanding How Trump’s Tariffs Trigger Market Volatility and Bitcoin’s Response

The cryptocurrency market was already showing bearish signals before Trump’s announcement, but his tariff declarations severely accelerated the downward trend. Bitcoin ETF outflows reached record highs as investors pulled back amid growing regulatory uncertainty.

Record Liquidations and Plummeting Prices

Bitcoin liquidations have approached $745 million following Trump’s EU tariff proposal. This comes after $1.5 billion in liquidations were recorded the previous day, demonstrating how rapidly market volatility can escalate in response to geopolitical developments.

The cryptocurrency market tanked as Bitcoin dropped below the value of $85,000, which it had kept since back in November 2024. The heavy collapse was preceded by bearish indicators, but Trump’s tariff announcement has been identified as an important element that also accelerated the market’s downward trajectory.

Also Read: Nvidia’s Q4 Revenue Soars 78% to $39.3B as AI Demand Explodes

Contagion Spreading to Crypto-Related Stocks

The impact of Trump EU tariffs extends beyond Bitcoin price drops, affecting crypto-related stocks significantly. Strategy (formerly MicroStrategy), which recently purchased nearly $2 billion in Bitcoin, saw its stock price plunge amid speculation it might need to liquidate its extensive holdings.

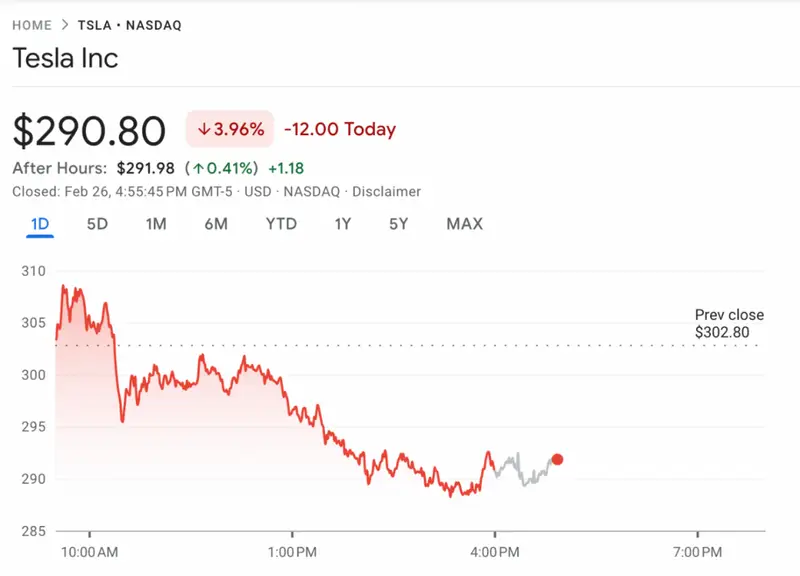

Coinbase took a few price hits but honestly recovered pretty quickly thanks to all those different money-making channels they’ve built. Meanwhile, Tesla got absolutely hammered from both sides – the crypto crash totally wrecked their Bitcoin profits, and a bunch of their regular customers started voicing some serious complaints about their actual products too.

Also Read: Cryptocurrency: 3 Coins You Could Buy At Discounted Rates

Long-Term Outlook

Despite all the immediate regulatory chaos and wild market swings triggered by Trump’s aggressive tariff announcements, several historical patterns actually point to some real potential for a solid recovery down the road.

While record-breaking hacks and social media scams have contributed to bearish sentiment, the underlying innovation in the blockchain space continues. Some analysts suggest the current correction may be healthy for long-term sustainability, allowing the market to reset after periods of overvaluation.

The regulatory landscape has spearheaded various major market disruptions following Trump’s tariff strategy, yet historical trend analysis actually reveals potential for significant recovery in upcoming quarters.

Also Read: Pi Network’s Market Cap Hits $16B: Is a Climb to $4 Next?

While those massive hacks and a bunch of social media scams have totally pushed investor sentiment into bearish territory, the core innovation across blockchain technologies keeps moving forward regardless. Industry experts suggest through several key observations that this market correction might actually create a healthier ecosystem long-term, giving markets some much-needed time to reset after experiencing multiple periods of serious overvaluation.