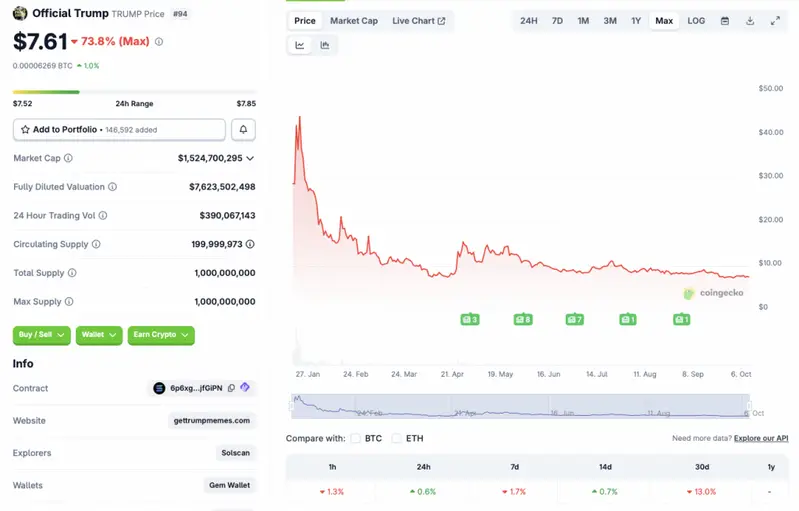

Trump Coin (Official Trump/TRUMP) launched just a few days before Donald Trump was sworn in as the 47th President of the United States. The Solana-based cryptocurrency saw a massive rally soon after its launch, hitting an all-time high of $73.43 on Jan. 19, the day of President Trump’s inauguration. Since its January peak, TRUMP’s price has fallen by nearly 90%. According to CoinGecko, the asset is currently down by 1.7% in the last week and 13% over the previous month. Despite the correction, the coin has made slight gains in the daily and 14-day charts, rallying 0.8% and 0.7%, respectively. In this price prediction article, let’s discuss if Trump coin can recover its losses anytime soon.

Trump Coin Price Prediction: Is A Recovery Possible Anytime Soon?

TRUMP’s price dip comes amid a decrease in popularity for President Trump’s trade policies. Many have blamed President Trump’s economic policies for the dwindling value of the US dollar. Poor dollar values have led investors to exit risky markets, such as cryptocurrencies, and instead put their money in safer options, such as gold.

The crypto market has also taken a hit over the last few days. The dip could be due to increased profit-taking or low investor sentiment. TRUMP and other memecoins have been severely affected by the macroeconomic conditions.

Despite the lackluster performance over the last few months, there is a chance that Trump coin will recover its losses over the coming months. There is a very high chance that the Federal Reserve will roll out another round of interest rate cuts after its next meeting. Another rate cut could inspire market participants to take heavier risks. Such a development could lead to TRUMP and other risky assets surging.

Also Read: US Treasury Plans to Mint $1 Coins with President Trump’s Face

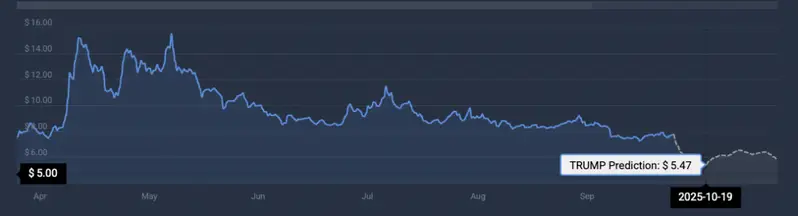

Despite the bullish possibilities, CoinCodex analysts do not anticipate TRUMP to recover anytime soon. Instead, the platform expects TRUMP’s price to go even lower. CoinCodex predicts TRUMP to trade at $5.47 on Oct. 19. Hitting $5.47 from current price levels will entail a dip of about 28.12%.