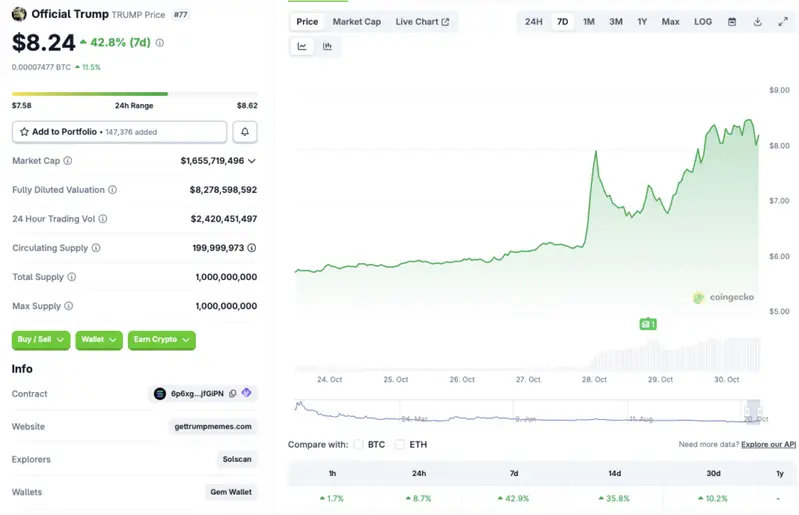

While the larger crypto market is facing a correction, Trump Coin (Official Trump/TRUMP) is registering gains on every time frame. According to CoinGecko data, Trump Coin has seen an 8.7% rally in the last 24 hours, a 42.9% rally in the last week, a 35.8% rally in the 14-day charts, and a 10.2% rally over the previous month. Let’s discuss why TRUMP’s price is going up, while most other crypto assets are facing corrections.

What’s Behind Trump Coin’s Price Rally?

Trump Coin’s latest price surge comes amid positive trade talks between the US and China. The crypto market faced its most significant single-day liquidation earlier this month after the two countries engaged in a trade dispute. The market slightly recovered after President Trump said that the two nations would finalize a new trade deal. However, the recent positive trade developments have led to a wider market rally. TRUMP is among the few crypto assets trading in the green zone today.

The market dip is also surprising given that the Federal Reserve announced another interest rate cut after the FOMC meeting. The dip could be due to Federal Reserve Chair Jerome Powell giving economic warnings during his speech. Powell stated that inflation has risen, and economic growth has been slow. Powell’s speech may have spooked investors away from risky assets, despite an interest rate cut. Trump Coin, however, may be riding the trade deal wave.

Also Read: Trump Says He May Announce New Fed Chair By The End of 2025

Given that the larger crypto market is in a slump, there is a high chance that Trump Coin’s price rally will also fizzle out. Bitcoin (BTC) is the market leader, and other assets tend to follow its trajectory. TRUMP’s rally is likely due to the trade deals with China, and may cool off as investors book profits.

CoinCodex analysts also paint a bearish picture for Trump Coin. The platform anticipates TRUMP’s price to fall to $5.73 on Nov. 8. Falling to $5.73 from current price levels will entail a correction of about 30.46%.