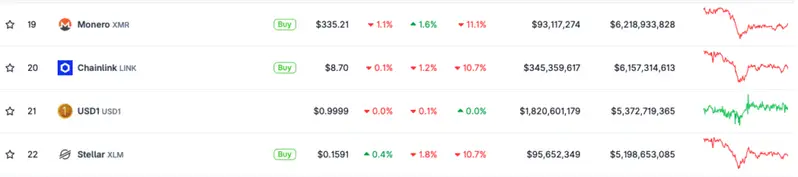

Trump Family-backed USD1 stablecoins has quickly climbed the charts, currently sitting at the 21st spot among the top projects by market cap, according to CoinGecko data. USD1 is issued by the Trump family-linked World Liberty Financial company, which also has crypto token, WLFI. World Liberty Financial has faced some controversy over the last few weeks. Let’s discuss what’s going on, and why USD1’s market cap is surging.

What’s Pushing Trump-Backed USD1’s Market Cap?

World Liberty Financial has been in the news over the last few days, and some have linked the firm’s success to Binance. A recent New York Times report noted that Binance gave World Liberty Financial a firm leg up. The report stated that the exchange “has become a vital engine of the Trump family’s business over the past two months.“

Also Read: Trump’s WLFI Spikes 10% In 24 Hours With Binance Support

Another report from Forbes says that Binance holds 87% of USD1’s supply, $4.7 billion of the total $5.4 billion. However, one of the terms of the exchange’s 2023 settlement with the US Treasury prohibits Binance from serving US clients. This means that the 87% of USD1 coins held in Binance could be held from customers outside the US. Forbes also highlights Binance’s promotion of USD1 in late January. The exchange announced that USD1 holders would be rewarded with $40 million worth of WLFI coins.

The Binance-World Liberty Financial connection may have risen after Trump pardoned CZ last year. World Liberty Financial was also in some controversy after a Wall Street Report came out that 49% of the company was purchased by a UAE-based firm, with links to royalty. President Trump’s family seems to be using the second term to solidify their position within the crypto sector. The first family has made massive gains with their crypto dealings, and its only been one year since Trump took office.