The speculation around a BlackRock XRP ETF has been picking up steam after BlackRock’s Maxwell Stein made some pretty bold statements at Ripple’s Swell conference. Right now, the possibility of an XRP ETF from BlackRock could actually reshape how institutional investors look at XRP, and it’s being seen as something that would bring real regulatory recognition along with serious institutional endorsement. The potential for an XRP price surge is tied directly to whether BlackRock’s growing interest in crypto adoption turns into actual products, because as Digital Asset Investor pointed out, while Swell conferences typically don’t move markets much, a BlackRock XRP ETF decision would be a completely different story for XRP’s valuation.

Also Read: Ripple XRP, Mastercard Add RLUSD Credit Settlements on Ledger

Xrp Price Surge And Institutional Adoption Amid BlackRock Crypto Decision

BlackRock Executive Signals Trillions Coming On-Chain

At this year’s Ripple Swell conference in New York, BlackRock’s Director of Digital Assets, Maxwell Stein, dropped what many are calling a bombshell statement that’s gotten the crypto community buzzing about a potential BlackRock XRP ETF.

Maxwell Stein stated:

“In the short-term, we need to prove the utility of the blockchain, but trillions are definitely coming on-chain.”

The two-day conference touched on Real World Asset tokenization and how institutions plan to move massive amounts of capital into blockchain technology. Adena Friedman, who serves as President and CEO of NASDAQ, also talked about how banks have already tokenized fixed income and bonds, and have even started creating stablecoins, especially CBDCs. Observers see these developments as signs of broader BlackRock crypto adoption and evidence that major financial institutions actually take blockchain seriously now.

Why A BlackRock XRP ETF Filing Would Change Everything

Digital Asset Investor made it pretty clear that Swell events usually focus on things like industry collaboration and blockchain integration—important topics for sure, but they typically reinforce long-term fundamentals without really producing any short-term price movements. However, he pointed out that a formal XRP ETF from BlackRock would be something entirely different, representing both regulatory recognition and institutional backing that could attract substantial capital inflows and shift how investors view XRP.

Robert Mitchnick, who heads up digital assets at BlackRock, has outlined the company’s framework for looking at crypto ETF opportunities. When interviewers asked him about potential future products, Mitchnick explained what drives their decision-making process.

Robert Mitchnick stated:

“I can say that for our client base, bitcoin is overwhelmingly the No. 1 focus and a little bit ethereum.”

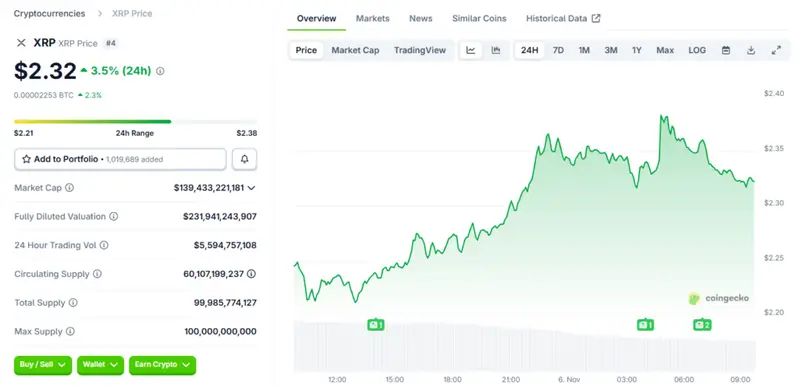

At the time of writing, XRP trades near $2.32 after dropping below the key support level of $2.52. Technical indicators point to renewed interest from large investors though—the Chaikin Money Flow shows 0.06 on TradingView, and analysts pair this with oversold conditions on the 4-hour RSI, suggesting that major investors might actually be accumulating XRP at these lower price levels. Analysts watch the $2.72 level as a possible target for any XRP price surge, but the price needs to hold above $2.32 first before significant upward movement happens.

What The BlackRock XRP ETF Decision Timeline Actually Looks Like

Ripple has been strategizing properly by applying to a standard banking license in the United States and this happened only a few months after they closed their SEC suit. Ever since the U.S. government included two major bills regulating the use of stablecoins into law the Genius and Clarity Acts, capital markets have been flooding money into the blockchain technology, which has provided a more favorable environment of more institutional players to enter the cryptocurrency market, led by BlackRock. Other analysts are even speculating that once BlackRock actually releases an XRP ETF, it will be able to draw in between 4-8 billion in institutional money in the first year alone.

Also Read: Analyst Predicts XRP Will Print the Biggest Green Candle in History

The market actors are still trying to draw the line between events that are largely symbolic and developments that actually count in financial terms- Swell conferences can still be essential in terms of creating alliances and demonstrating global presence, but a BlackRock XRP ETF approval would have far more profound implications in terms of liquidity and providing easier access to XRP by the investors. The increased enthusiasm behind crypto adoption by BlackRock in the form of tokenization projects and the possibility of a major XRP price explosion is actually just a matter of whether these institutional products will actually receive formal approval and to whether the regulatory environment continues to get better.