According to Cointelegraph, a solo miner turned less than $100 into nearly $271,000 after earning 3.152 BTC for successfully mining Bitcoin block 928351. The Bitcoin (BTC) miner’s money grew by nearly 270,900%, or 2709x. The person in question rented less than $100 worth of hashpower on NiceHash, an open marketplace for buyers and sellers of hashing power.

Bitcoin Shows Consolidation Signs

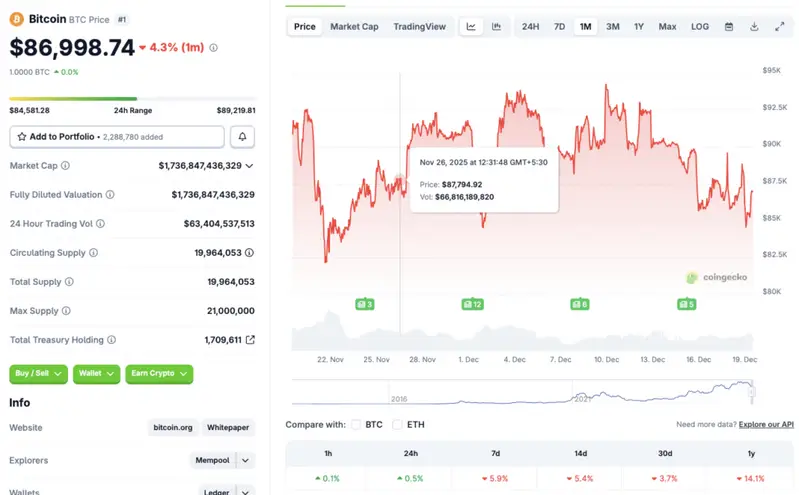

Bitcoin (BTC) seems to be consolidating around the $86,000 price level. According to CoinGecko’s BTC data, the asset has rallied by 0.5% in the last 24 hours, but is down 5.9% in the last week, 5.4% in the 14-day charts, 3.7% over the previous month, and 14.1% since December 2024.

The Bitcoin and the larger crypto market’s suffering arises from macroeconomic developments. Slow economic growth and high jobs figures have led to substantial inflation worries. Japan recently increased its interest rates by 75 basis points, the highest in nearly 30 years. On the other hand, inflation in the UK has dipped for November, prompting many to expect an interest rate cut in the nation. However, rate cuts in the US have not had the desired impact on the crypto market. Bitcoin (BTC) and other assets faced substantial price dips after the Fed’s October and December rate cuts.

Given the current market scenario, we may be entering another long crypto winter. However, Bitcoin (BTC) may maintain the $80,000-$85,000 price level, instead of falling to $15,000 as it did in the last crypto winter.

Also Read: Bitcoin Rewards Patience as Fifth Golden Cross Flashes: What It Means

While Bitcoin (BTC) seems to see no recovery in sight in the short term, many anticipate the asset to hit a new peak in 2026. Bernstein and Grayscale expect Bitcoin (BTC) to climb to a new all-time high next year, while Barclays presents a more bearish outlook for the crypto market.