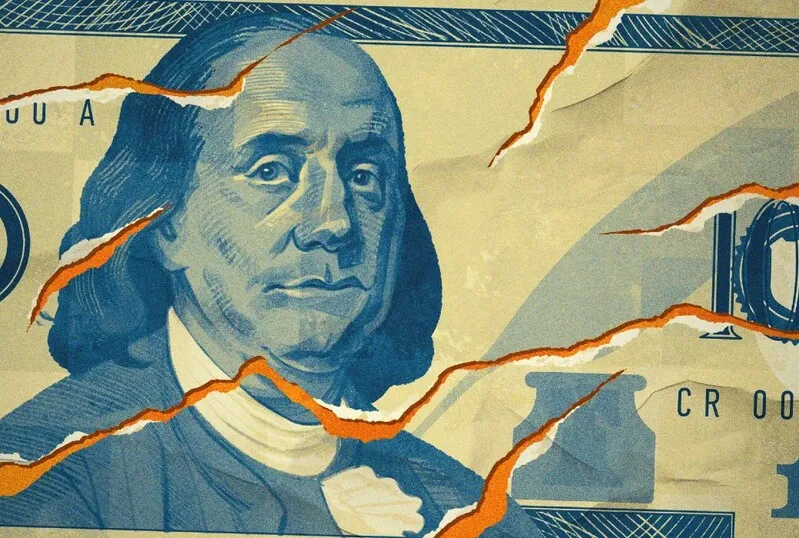

The world is diversifying its central bank reserves with gold and other currencies by selling the US dollar in 2025. While Donald Trump’s goal is to maintain the hegemony of the USD, developing nations are aiming to puncture its dominance. Both are determined to achieve their target, but only one can be declared the winner in the coming decades. At first, the de-dollarization agenda was limited only to the Global South and other leading Asian countries. Thanks to Trump’s tariffs and trade wars, allies in Europe and other Western nations are considering bolstering their currencies.

Also Read: US Dollar Weakens Against Nigerian Naira in the Currency Markets

The US dollar-denominated assets are declining in value, with trust in the currency being eroded. The foreign policies emerging from the White House are fueling the de-dollarization agenda and making foes turn friends in trade. China and India, which were at loggerheads over trade due to border disputes, are now coming together. The survival mode has kicked in with the US dollar being the main villain, and the world is selling it at a record pace. The growing national debt in the US, touching $36 trillion, is a cause of concern to countries holding the currency.

World Selling the US Dollar-Denominated Assets Reaches a New High

Whether the US will have the upper hand in protecting its currency or whether the multipolar world takes shape, the upcoming decade will provide the answer. The Financial Times published a detailed analysis from George Saravelos, the Global Head of FX Research at Deutsche Bank, citing that the world is selling all US dollar-denominated assets simultaneously.

Also Read: 3 Economics To Lead De-Dollarization: What’s Going On?

The world selling the US dollar could make the American economy weaker. “We are witnessing a simultaneous collapse in the price of all US assets, including equities, the dollar versus alternative reserve FX, and the bond market,” wrote Saravelos. “We are entering uncharted territory in the global financial system. The market has lost faith in US assets, so that instead of closing the asset-liability mismatch by hoarding dollar liquidity, it is actively selling down the US assets themselves.”