Tesla stock jumped 2% after hours as President-elect Trump named Elon Musk to lead the Department of Government Efficiency (D.O.G.E), a move to cut federal spending and streamline bureaucracy amid market volatility. The news triggered significant changes in both government direction and market confidence.

Also Read: XRP’s Rare Pattern: Top Trader Predicts $1 After 17% Surge

Musk’s Influence on Tesla Stock and Market Stability: Exploring D.O.G.E and Government Efficiency

Strategic Appointment Impact

The D.O.G.E initiative puts Musk in charge of a bold plan to cut federal spending. Tesla’s CEO states that he can reduce $2 trillion from the current $6.75 trillion yearly budget by cutting regulations and reshaping agencies. Working with Vivek Ramaswamy, Musk will tackle bureaucratic barriers and improve federal operations in this non-government role.

Market Response and Trading Activity

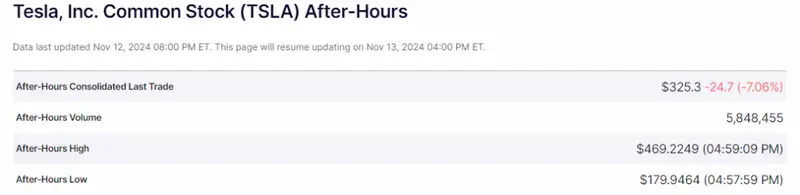

Tesla stock dropped 6.15% in regular trading but gained 2% on Robinhood after hours. The appointment builds stronger links between Musk and the incoming administration. Investors see possible benefits for Tesla’s operations ahead. Market experts point to rising faith in government reform plans.

Also Read: AI Predicts Bitcoin’s Price (BTC) As Musk Debuts As DOGE Dept’ Lead

Implementation Timeline and Objectives

The program runs until July 4, 2026 – America’s 250th independence anniversary. Musk promises to “send shockwaves through the system,” yet new laws must wait until after the 2026 midterms. The timeline shows a focus on lasting improvements rather than quick changes.

Operational Challenges and Opportunities

Questions remain about Musk’s ability to balance Tesla’s duties with D.O.G.E work. His advisory status offers scheduling freedom. Ramaswamy’s presence strengthens the initiative, though social media notes the irony of naming two leaders for an efficiency project.

Also Read: Did Donald Trump’s Crypto Portfolio Decline Post Election Victory?

TSLA Future Outlook and Market Implications

Investors remain positive about Tesla’s prospects through enhanced government efficiency. This role shows how commited they are to reducing federal costs. This could have potential benefits for both public operations and private markets. D.O.G.E’s success could transform government-business relationships while strengthening Tesla’s market position.