There are few companies that have struggled in 2025 as much as Tesla has. It is seeing global interest in its electric vehicles struggle as the company’s share price has fallen more than 22% over the last month. Yet, as Tesla (TSLA) has seen Europe sales fall 45% in January, the stock still stands as a clear high-risk, high-reward bet on Wall Street.

Although there is reason to be pessimistic about the company this year, there is also some upside related to the stock. Indeed, it still has tremendous potential, with the technological developments of the company proving to be a point of focus. If it does hit on some of its more ambitious projects, it could make up for much of its losses and then some.

Also Read: Tesla: Wolfe Research Calls TSLA Best Stock For One Purpose

Tesla Europe Sales Plummet: So Why Does TSLA Still Have So Much Upside?

On Monday, Tesla stock plummeted another 7%. That move kept pace with what has been a growing trend and concern amid a whirlwind year for the company. In October of 2024, they had just announced their Robotaxi project that would transform autonomous driving. Yet, fast-forward to February 2025, and Elon Musk is engrained in a position on Capitol Hill, running US President Donald Trump’s DOGE Commission.

With so much change, it looks like the EV manufacturer has taken the biggest hit. Indeed, Tesla (TSLA) has seen its Europe sales fall 45% since January of 2024, as the stock is proving to be one of Wall Street’s high-risk, high-reward bets, despite its falling value.

Also Read: Tesla (TSLA) Falls 30% From All-Time High as Experts See One Big Problem

The company’s market share in Europe dropped to 1% from its previous 1.8%, as it fell behind China’s SAIC Motor, according to Business Insider. Moreover, the competitor saw its market share jump from 1.7% to its current 2.3% in what is shifting momentum.

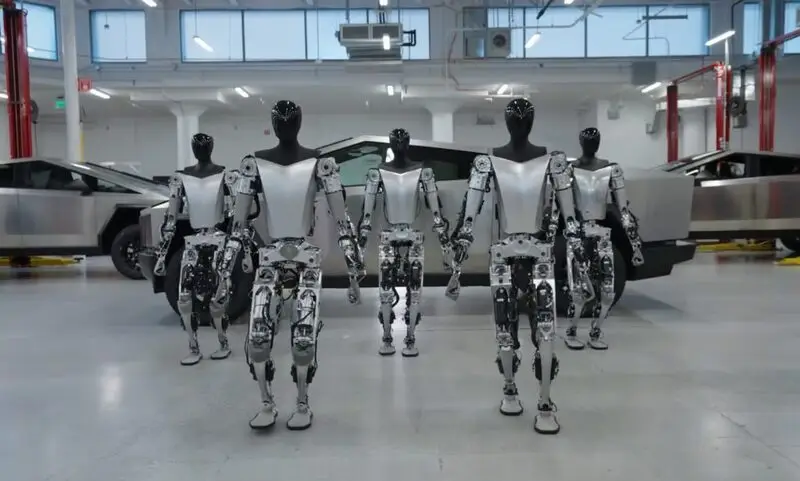

However, with so much bad abounding in Tesla, there is tremendous potential. Specifically, its Robotaxi and Optimus robots prevent some upside. The question is, just how much? Well, Wall Street is currently expecting it to fall even further or explode.

Of 56 analysts surveyed by CNN, only 46% have a buy rating on the stock. Alternatively, 30% have called to hold, with 23% urging investors to sell. Moreover, it holds a median price target of $412, up 33%. However, its high-end projection sits at $1,000 and represents a 225% upside. Meanwhile, its low-end forecasts sit at $135, with a downside of 56%.