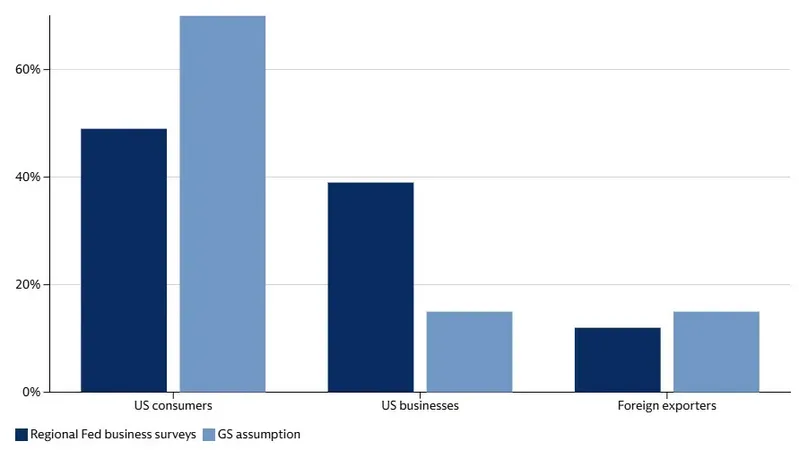

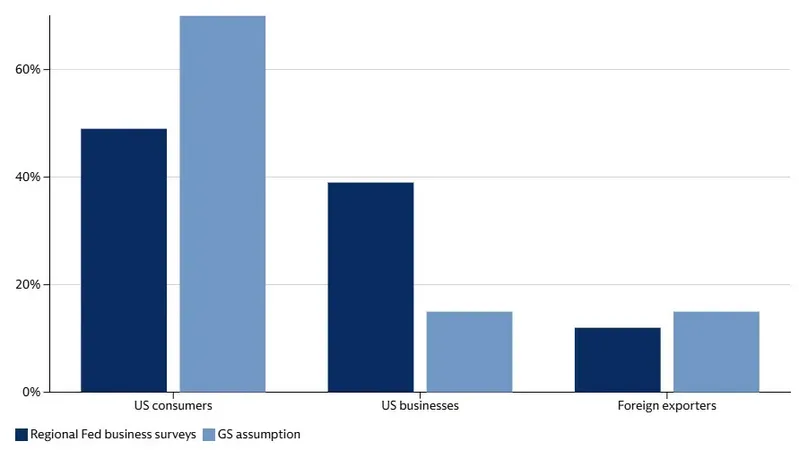

Goldman Sachs tariffs research shows that US consumers will actually end up bearing 67% of trade war costs as the burden gets shifted from businesses. Right now, the Goldman Sachs Trump tariffs analysis reveals consumers are absorbing just 22% of tariff expenses, while companies are shouldering about 64%. This major shift is happening even as BRICS response to tariffs becomes more intense, with countries like India and Brazil facing 50% tariff increases. The Goldman Sachs tariffs report clearly answers who pays for trade tariffs by showing consumer costs will triple as businesses pass on their expenses.

Also Read: Goldman Sachs: De-Dollarization Forecast Spurs New Financial Trends

Goldman Sachs Tariffs Report Explains Who Pays Amid BRICS Response

Consumer Burden Set to Triple Under Goldman Sachs Analysis

Goldman Sachs tariffs data actually shows American businesses are currently absorbing most costs but will shift around 67% to consumers. The effective US tariff rate has been raised by roughly 10 percentage points to 13%, and economists are projecting an additional 4-point increase to 17%.

David Kostin, chief US equity strategist at Goldman Sachs, stated:

“Clients have been keenly focused on who will ultimately shoulder the cost of tariffs.”

Companies have announced some modest price increases this year. However, firms most exposed to Goldman Sachs tariffs are showing larger hikes. The bank assumes companies will pass on about 70% of direct tariff costs to consumers through higher prices.

Source: Federal Reserve, Goldman Sachs Research

BRICS Response to Tariffs Escalates Diplomatic Tensions

The BRICS response to tariffs has actually triggered coordinated pushback against Goldman Sachs tariffs Trump policies. India is facing doubled tariffs to 50% on goods, which has been linked to Russian oil imports that account for 36% of total purchases. Brazil encountered similar 50% increases along with other pressures.

Brazilian President Lula da Silva rejected direct negotiations, stating:

“I will not call Trump to negotiate anything I’m not going to humiliate myself.”

Prime Minister Modi has been engaging with Putin and Lula, with some reports suggesting Putin will visit New Delhi. This diplomatic activity is directly responding to who pays for trade tariffs pressure.

Corporate Earnings Reflect Goldman Sachs Tariffs Impact

S&P 500 earnings-per-share growth is decelerating to 4% this quarter from 12% previously, which reflects Goldman Sachs tariffs strain. Companies are navigating between maintaining margins and absorbing costs from the current BRICS response to tariffs situation.

David Kostin noted:

“Companies have so far only announced modest price increases this year, although increases have been larger among firms most exposed to tariffs.”

Goldman Sachs actually forecasts S&P 500 earnings will grow 7% in 2025 to $262, incorporating tariff drag on growth. The bank projects 3.5% returns over 12 months, reaching 6500.

David Kostin stated:

“We expect the S&P 500 in aggregate will beat the low bar set for the second quarter.”

Also Read: BRICS vs US: How Members Are Being Targeted One-By-One

The Goldman Sachs tariffs analysis reveals how who pays for trade tariffs is shifting dramatically from businesses to consumers, while the BRICS response to tariffs creates additional geopolitical tensions that are affecting global markets right now.