T-Mobile stock dropped 5% Monday as EchoStar announced a $17 billion spectrum sale to SpaceX, and also T-Mobile representatives are quitting over aggressive T-Life app mandates. This T-Mobile news highlights dual challenges that are actually facing the carrier right now amid T-Mobile SpaceX competition along with internal transformation struggles.

Also Read: GameStop Stock Jumps After GME Earnings Beat and Dividend Warrant

T-Mobile Reps Quit as Stock Falls on SpaceX Deal and Digital Shift

The market reaction was pretty harsh and reflects concerns about increased competition as T-Mobile SpaceX partnership dynamics shift. T-Mobile shares were hit alongside AT&T and Verizon following EchoStar’s announcement, which created significant news coverage of the spectrum transaction.

SpaceX is getting 50 MHz of exclusive S-band spectrum in the United States from this deal, and this allows them direct-to-cell services without having to rely on T-Mobile partnerships anymore. The deal consists of up to $8.5 billion in cash along with $8.5 billion in SpaceX stock.

Gwynne Shotwell, SpaceX president and COO, stated:

“We’re so pleased to be doing this transaction with EchoStar as it will advance our mission to end mobile dead zones around the world.”

Hamid Akhavan, EchoStar president and CEO, had this to say:

“For the past decade, we’ve acquired spectrum and facilitated worldwide 5G spectrum standards and devices, all with the foresight that direct-to-cell connectivity via satellite would change the way the world communicates.”

T-Mobile Representatives Are Walking Away

T-Mobile reps are actually quitting due to mandatory requirements to process 60-90% of customer transactions through the T-Life app. Multiple experienced representatives have resigned in recent weeks, and they’re citing unbearable pressure along with app functionality issues.

One former manager posted on social media:

“Resigned after 8.5 years of hard work and dedication to this company. TMO isn’t a career anymore, but a shitty job with glorified benefits to keep you around, which most companies offer nowadays. T-Life push is unreal for the front-line employees. Another way of taking money from my reps. As a manager, I’ve heard things about how it’s going to get worse.”

Another former rep wrote:

“I quit after 6 years because of T-Life as well. I ran a successful store, had a great team, and worked for the best market manager I’ve ever met. It still wasn’t enough after T-Life. T-Life was created to thin the ranks; mission accomplished. But it’s only the good people leaving.”

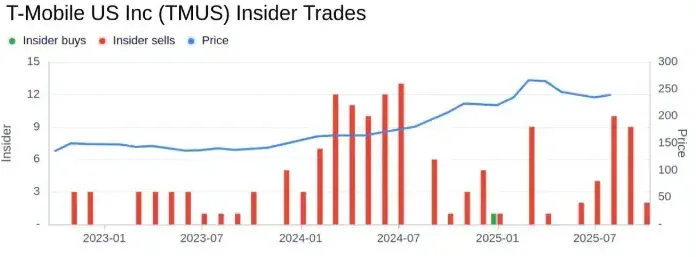

Stock Performance Takes a Hit

T-Mobile stock now trades at $249.83 and there are concerns about overvaluation amid this T-Mobile stock news today. Recent insider selling is adding pressure, with CEO Mike Sievert selling 22,500 shares and this latest news showing continued market uncertainty right now.

The company is facing regulatory scrutiny alongside competitive pressures. T-Mobile recently paid a $92 million FCC fine for selling customer location data without consent, which adds to investor concerns about the carrier’s operational challenges.

Also Read: OCTO Stock Skyrockets Over 3000% After $250M Worldcoin Deal

The combination of external T-Mobile SpaceX competitive pressures and internal digital transformation issues is creating uncertainty. This T-Mobile stock news today reflects broader challenges as industry observers suggest the company transitions toward an all-digital model.