Sui ETF developments have reached a crucial milestone as 21Shares officially files with Nasdaq to list the first spot Sui ETF in the United States. This regulatory filing has triggered significant cryptocurrency market volatility around SUI tokens, with current investment risks being weighed against the potential for substantial gains. Early SUI price prediction models suggest the token could reach $6 by summer, representing a potential 50%+ rally from current trading levels amid ongoing Nasdaq listing procedures.

🚨BREAKING: 21Shares files the first-ever SUI ETF on Nasdaq!

— Coin Bureau (@coinbureau) May 27, 2025

The filing, under Section 19(b)(2) of the Securities Exchange Act, marks a key step toward potential SEC approval. Bullish for $SUI! 🚀 pic.twitter.com/IA3Dyk1QdS

Navigating Sui ETF Nasdaq Listing Amid Cryptocurrency Market Volatility

21Shares Leads Historic Sui ETF Filing Wave

The financial landscape shifted dramatically on May 27, 2025, when 21Shares submitted its Form 19b-4 application to the Securities and Exchange Commission through Nasdaq, marking the first comprehensive attempt to bring a spot Sui ETF to American markets. This Sui ETF filing represents institutional confidence in Layer 1 blockchain tokens beyond Bitcoin and Ethereum.

📢 New Progress Update – A Path Forward Together!

Since the incident, we have reflected deeply on the incident and its impact on our users, partners, and the broader ecosystem. We are deeply sorry and take this responsibility seriously. Today, we want to share a meaningful step…— Cetus🐳 (@CetusProtocol) May 27, 2025

The Swiss asset manager’s regulatory submission comes with substantial backing, having already established successful Sui exchange-traded products on European markets and also maintaining operations across multiple jurisdictions. These European listings have accumulated approximately $317.2 million in assets under management, demonstrating sustained institutional appetite for Sui ETF exposure right now.

Also Read: Ripple Price Prediction: $5K in XRP Could Flip Your Future with 580% as ETF Launches

Market Response Shows Bullish SUI Price Prediction Momentum

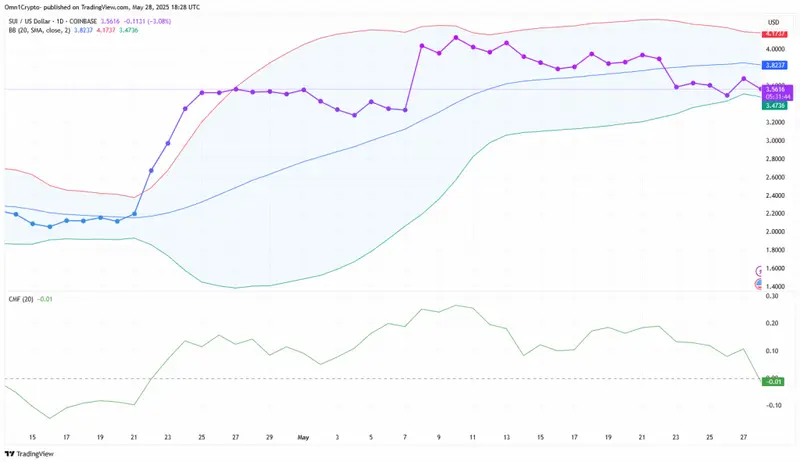

SUI tokens experienced an immediate 8% surge following the Nasdaq listing announcement, with trading volumes increasing substantially as market participants positioned themselves around the Sui ETF narrative. The token briefly touched resistance levels near $3.80, suggesting underlying strength despite cryptocurrency market volatility pressures and also broader market uncertainties.

According to current analysis, SUI price has broken free of pattern-driven constraints that have limited prices since last March and is now poised to rise even more. Analysts think resistance is likely at $4.20 – $4.30 and a jump through this level could lead to growth toward the $6 zone as the approval process for the Sui ETF moves ahead.

Michael van de Poppe stated:

”SUI is strongly coming back after some FUD surrounding the Cetus exploit. The TVL has already bounced up with $300M and is back to $1.8B TVL. I think that SUI remains to be a strong horse in the race of adoption and the stabilization on price proves this.”

$SUI is strongly coming back after some FUD surrounding the Cetus exploit.

— Michaël van de Poppe (@CryptoMichNL) May 28, 2025

The TVL has already bounced up with $300M and is back to $1.8B TVL.

I think that $SUI remains to be a strong horse in the race of adoption and the stabilization on price proves this.

Additionally,… pic.twitter.com/17EgM48DIv

Investment Risks and Regulatory Timeline for Sui ETF

While the Sui ETF represents significant progress for altcoin institutional adoption, investment risks remain substantial throughout the approval process and also during the review period. The SEC maintains an extensive review period of up to 240 days for ETF applications, with potential delay scenarios that could impact SUI price prediction trajectories and create additional cryptocurrency market volatility.

At the time of writing, recent Cetus protocol exploit events highlighted ongoing technological investment risks associated with DeFi protocols and blockchain security concerns. However, the Sui Foundation’s swift response demonstrated network governance capabilities under stress and also showed institutional preparedness.

The Cetus Protocol had this to say:

”Since the incident, we have reflected deeply on the incident and its impact on our users, partners, and the broader ecosystem. We are deeply sorry and take this responsibility seriously.”

Will $SUI hit $10 this bull run?

— Crypto Patel (@CryptoPatel) May 27, 2025

Our first entry was at $0.60 — and the trend still looks strong! 🔥

If price dips into the $3.10–$2.50 demand zone, I’ll be accumulating more.

Structure still bullish. Momentum intact.

Just waiting for a clean retest before next leg up.… pic.twitter.com/hxbNRTr9q5

Current SUI price prediction models incorporate both bullish Sui ETF approval scenarios and also bearish regulatory rejection possibilities. Conservative estimates place the token between $3.20-$4.50 through summer 2025, while optimistic projections targeting $6+ assume successful approval despite ongoing cryptocurrency market volatility and investment risks in this sector right now.

Also Read: Goldman Bets $1.4B on BlackRock’s Bitcoin ETF; 516 Trillion SHIB Set to Hit Market