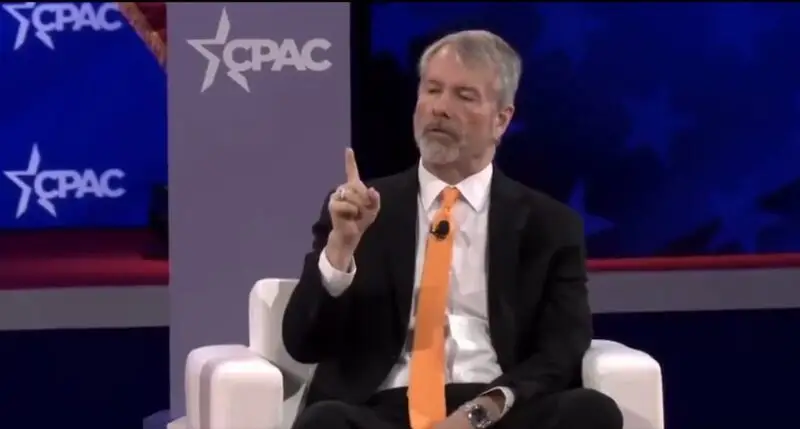

In a rather surprising development for the overarching industry, Strategy founder Michael Saylor has called proof-of-reserves a “liability” in a recent statement. Indeed, Saylor discussed the concept but rejected it on that basis, drawing the concern of many within the industry.

Saylor had led his firm, the former MicroStrategy, to being one of the most prominent Bitcoin holders on the planet. Indeed, the firm holds more than 580,000 BTC, with more being added seemingly by the week. Yet, his recent statements on disclosures have many confused and seeking even more answers.

Also Read: Class Action Lawsuit Filed Against Michael Saylor’s Strategy Over Bitcoin

Michael Saylor Rejects Proof-of-Reserves in Shocking Statement

There are few people as connected with Bitcoin and the cryptocurrency sector as Michael Saylor is. The executive has been a champion of the asset class for years. Moreover, his technology firm has been one of the biggest buyers of the asset class, putting their money where their mouth is.

Yet, he has recently drawn some criticism for a rather interesting position he took on a vital aspect of the sector itself. Indeed, Strategy founder Michael Saylor recently called proof-of-reserves a liability in a statement. Specifically, he said as much while rejecting the practice of disclosing proof of holdings.

Also Read: Saylor Proposes $81 Trillion Bitcoin Reserve to Reinvent US Financial System

“If you publish your wallets, that’s an attack vector for hackers, nation-state actors, every type of troll imaginable,” Saylor said in a recently surfaced X (formerly Twitter) post. “It creates so much liability you should think twice before you ever do it,” he added.

Additionally, Saylor noted these reverses aren’t an accurate representation of a company’s financial health. However, it stands in the face of common practice. After the collapse of FTX, proof-of-reserve audits became commonplace to ensure individuals could observe disclosed funds.

Without that, they are unable to verify the well-being of a customer, and thereby they are unable to verify the well-being of their own funds. He may encourage thinking twice before publishing the audit, but any investor should think twice before putting money into a company refusing the disclosure.