Strategy‘s Bitcoin buys reached a new milestone as the company filed for a Euro IPO on November 3, 2025, and at the time of writing, the move represents one of the boldest steps in corporate crypto adoption. The firm plans to offer 3.5 million shares of STRE, which is actually its first Euro-denominated perpetual preferred stock, with net proceeds being allocated toward purchasing additional Bitcoin. The STRE dividend stock provides a 10% yearly cumulative dividend on 100 euros, paid quarterly starting December 31, and it’s targeting qualified institutional investors in the EU and UK right now.

Euro IPO Powers Strategy’s Bitcoin Buys With STRE Dividend Treasury Model

STRE Stock Launch Details

This Euro IPO will actually fund Strategy Bitcoin buys, and it restricts participation to qualified investors only. This approach targets institutional players who are capable of meeting specific regulatory requirements, and it also provides steady income through the 10% dividend structure.

Michael Saylor announced the offering on social media, and he had this to say:

“Strategy is offering $STRE (‘Stream’), our first ever Euro-Denominated Perpetual Preferred Stock, to European and global institutional investors.”

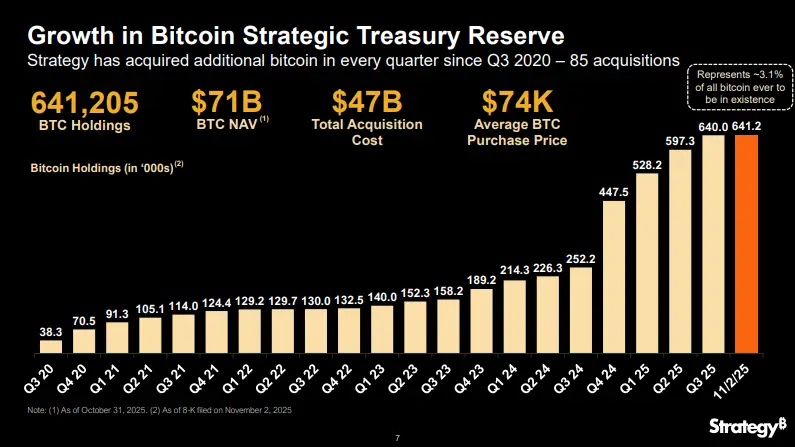

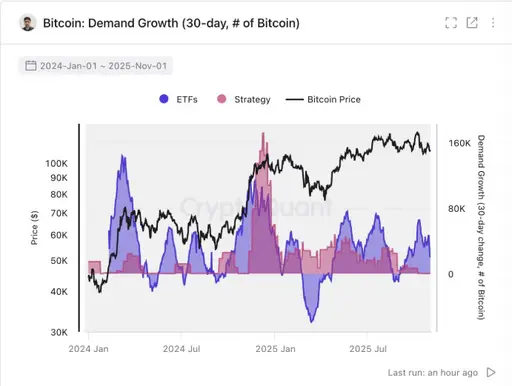

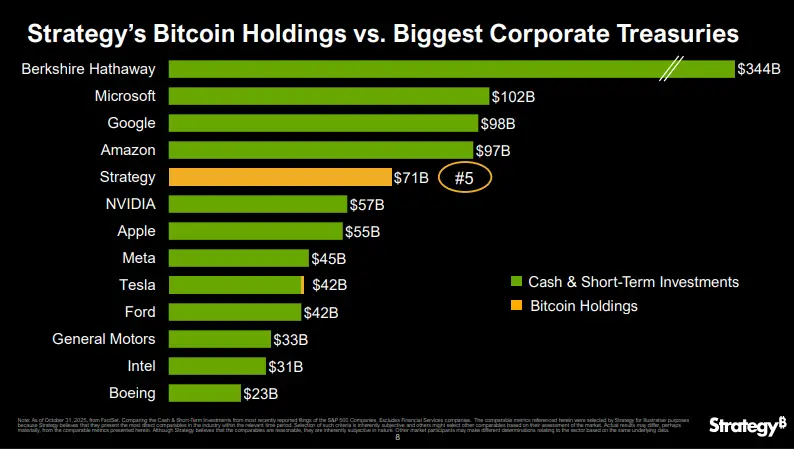

The crypto treasury model continues driving Strategy Bitcoin buys right now, with the company currently holding 641,205 BTC that was acquired for $47.49 billion. The firm announced it purchased 397 Bitcoin on Monday to kick off November, which demonstrates its ongoing accumulation strategy even as market conditions evolve.

Also Read: Saylor Signals MicroStrategy Bitcoin Buy, Predicts $21M by 2046

Management Strategy and Market Position

Saylor told investors on Thursday regarding the company’s approach, and his comments were clear:

“The focus is to sell digital credit, improve the balance sheet, buy Bitcoin and communicate that to the credit and the equity investors.”

He also addressed merger speculation, noting Strategy does not have plans to pursue acquisitions “even if it would look to be potentially accretive.” This Euro IPO represents the latest mechanism for Strategy Bitcoin buys, along with Barclays, Morgan Stanley, Moelis and TD Securities serving as book-running managers for the offering.

Also Read: MicroStrategy Bitcoin Investment Now at $4.65B Unrealized Profit

The STRE offering provides European institutional investors access to Strategy’s crypto treasury model through a regulated dividend-paying instrument, and it addresses concerns about direct cryptocurrency exposure while maintaining the company’s focus on aggressive Bitcoin accumulation strategies.