The Strategy class action lawsuit has hit MicroStrategy (now operating as Strategy) again, after the company faced a massive $5.9 billion Bitcoin loss that investors claim was the result of MicroStrategy stock fraud. I think this is a very interesting setup. This latest and greatest legal battle centers on Michael Saylor Bitcoin losses and how Strategy has allegedly misled shareholders about crypto risk. This has also sparked an MSTR investor lawsuit over crypto stock manipulation tactics. When it rains, it pours, right?

Also Read: MSTR Slides as Strategy Bags 7,390 BTC, Faces Lawsuit, $1,800 Target Still In Sight

Strategy Class Action Lawsuit Alleges Crypto Stock Manipulation

The case is a Strategy class action litigation that takes place in the United States by a complaint in the Eastern District of Virginia at docket 25-cv-00861. This latest and greatest complaint is aimed at the company now known as MicroStrategy and its executives. I am not surprised considering the number of lawsuits the company faced lately. This MSTR investor action says it all, and it is an action on behalf of its investors, who purchased securities during the period of April 30, 2024, to April 4, 2025. It claims violations of federal securities laws, as well as some damages.

Michael Saylor Bitcoin Losses Trigger Legal Action

The crux of the Michael Saylor Bitcoin losses is that Strategy has also adopted some new accounting rules that became effective January 1, 2025. ASU 2023-08 is its name, and it mandates the fair value reporting of crypto assets, including unrealized gains and even losses in quarterly earnings, is currently posing serious financial reporting issues to the company.

Strategy also said that: “We may not be able to regain profitability in future periods, particularly if we incur significant unrealized losses related to our digital assets.”

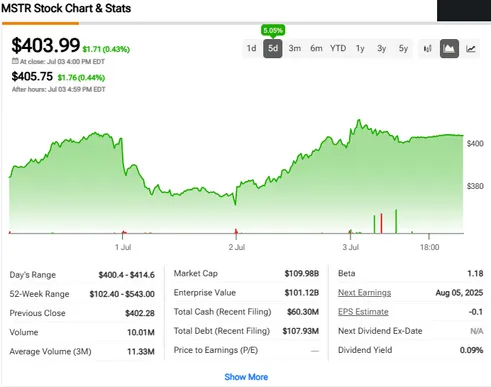

The impact was severe when Strategy revealed a $5.91 billion unrealized loss on April 7, 2025, causing the stock to fall $25.47 per share, or 8.67%, to $268.14. At the time of writing, this represented one of the largest crypto-related corporate losses reported.

Also Read: Class Action Lawsuit Filed Against Michael Saylor’s Strategy Over Bitcoin

MicroStrategy Stock Fraud Allegations Detailed

The MicroStrategy stock fraud allegations center on the company’s failure to adequately disclose risks associated with the new accounting standards. The lawsuit claims Strategy made false statements by overstating profitability while also understating Bitcoin volatility risks and potential losses under fair value accounting.

The complaint alleges Strategy engaged in crypto stock manipulation by consistently providing optimistic assessments through metrics like “BTC Yield” and also “BTC Gain” while omitting potential massive losses under the new accounting methodology. This Strategy class action lawsuit also highlights how companies can mislead investors by focusing on positive metrics while downplaying risks.

Also Read: Strategy Misses BTC Rally as Saylor Hides $14B Reserves

Investors have until the date of July 15, 2025, to join the Strategy class action lawsuit as lead plaintiff. This investor lawsuit against a MSTR may establish valuable precedent of how crypto-related companies need to inform investors about risks of holding crypto assets given that accounting and even regulatory rulings are currently shifting toward crypto-asset holdings.