Stablecoins adoption trends are actually surging right now as Central Bank Digital Currencies face widespread abandonment across the globe. Former Binance CEO Changpeng “CZ” Zhao recently declared that CBDCs are “outdated“ while digital currencies that are backed by real collateral continue gaining momentum. At least 10 countries have halted their CBDC projects at this point, which marks a clear CBDC decline as fiat-backed stablecoins receive regulatory support through various frameworks like the US GENIUS Act.

Stablecoins Adoption Trends Surge While CBDC Decline Sparks Global Interest

The global shift toward stablecoins adoption trends became pretty evident during CZ’s recent Tokyo speech, where he emphasized how digital currencies are reshaping financial systems worldwide right now.

CZ said:

“Central Bank Digital Currencies are already outdated. In contrast, stablecoins are gaining more attention.”

The Great CBDC Abandonment Actually Accelerates

Countries like Japan, Denmark, Finland, Singapore, South Korea, and also the United States have paused their CBDC pilot projects, citing high costs along with lack of retail demand. The CBDC decline reflects growing concerns about government control and privacy issues that stablecoins adoption trends have addressed more effectively.

CZ is convinced about the fact that:

“Stablecoins are more likely to be accepted by the wider market as they are backed by real collateral and support.”

Also Read: GENIUS Act: Experts Warn It’s Actually Hidden CBDC System

Regulatory Support Drives Fiat-Backed Stablecoins Growth

The GENIUS Act’s passage through Senate committee and Trump’s endorsement signal strong regulatory backing for fiat-backed stablecoins. Standard Chartered actually projects the stablecoin sector will reach $2 trillion, which would require $1.6 trillion in additional Treasury reserves. This massive growth in stablecoins adoption trends demonstrates market preference for digital currencies with transparent backing.

Geoff Kendrick from Standard Chartered also said:

“US legislation on stablecoins would further legitimize the stablecoin industry. This has implications for both US Treasury buying and USD hegemony.”

Even China, despite its crypto ban, is exploring yuan-backed digital currencies as CZ Zhao insights reveal global recognition of stablecoins’ dominance over traditional CBDC approaches. The CZ Zhao insights from his WebX conference appearance also highlight how some countries that were experimenting with CBDC projects as early as 2013 or 2014 have seen these initiatives fade into obscurity after stablecoins exploded in the market.

Also Read: Bank of England Abandons CBDC as US House Passes Anti-CBDC Ban

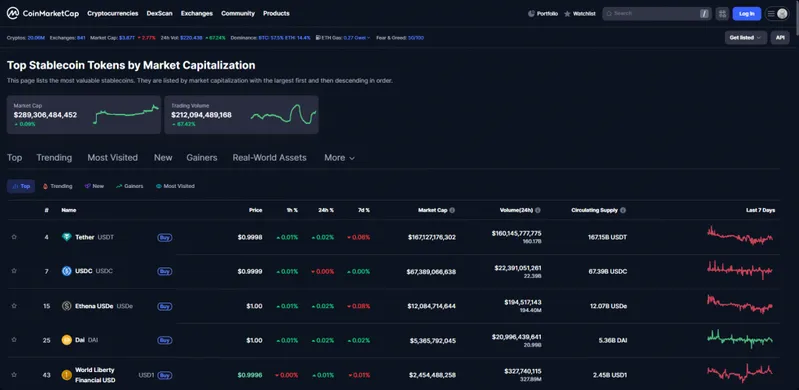

The stablecoins adoption trends reflect fundamental market demands that CBDC decline has failed to address, positioning fiat-backed stablecoins as the winning solution in the digital currencies race. At the time of writing, the stablecoin market sits at around $260 billion, and these CZ Zhao insights suggest that fiat-backed stablecoins will continue dominating as governments abandon their CBDC initiatives.