South Korea CBDC pause represents a major shift as the Bank of Korea suspends its digital currency pilot to focus on won-backed stablecoin launch. This CBDC pilot suspension comes amid growing support for Korean stablecoin regulation over government-issued digital currencies, and also signals a broader change in the country’s approach.

The Bank of Korea halted its digital currency project, called “Project Han River,” after banks raised concerns about costs and also unclear commercialization plans. Such South Korea CBDC pause signals the country’s pivot toward private stablecoin development right now.

Also Read: 9 Countries Push CBDCs To End Fiat Currencies

CBDC Pause Signals Korea’s Shift to Regulated Stablecoin Rollout

The South Korea’s CBDC pause affects seven participating banks that were informed discussions would be temporarily suspended. The Bank of Korea digital currency testing was scheduled for Q4 2025 but has been postponed as authorities reassess the role of CBDCs and also evaluate stablecoin alternatives.

A senior official at one of the seven banks taking part in the tests told Yonhap:

”The central bank is waiting to see the government’s plans for stablecoins and how a CBDC would fit with such tokens.”

Banks expressed dissatisfaction with the expensive CBDC pilot suspension, and also preferred to focus on won-backed stablecoin launch opportunities instead. This dissatisfaction showcases the implications of the South Korea CBDC pause on future bank strategies.

Banks Reject Costly CBDC Program

The CBDC pilot suspension came after participating banks complained about high costs and also lack of clear profit models. One senior banking official said the second part of the CBDC trials was already “on the verge of collapse” as banks became unhappy with expenses. Hence, the South Korea CBDC pause adds pressure to reevaluate the costs involved.

At the time of writing, Korean stablecoin regulation offers clearer profit potential compared to the uncertain Bank of Korea digital currency project. Eight major banks, including KB Kookmin and also Shinhan, have launched a joint won-backed stablecoin launch initiative, following the South Korea CBDC pause.

Political Support Drives Stablecoin Focus

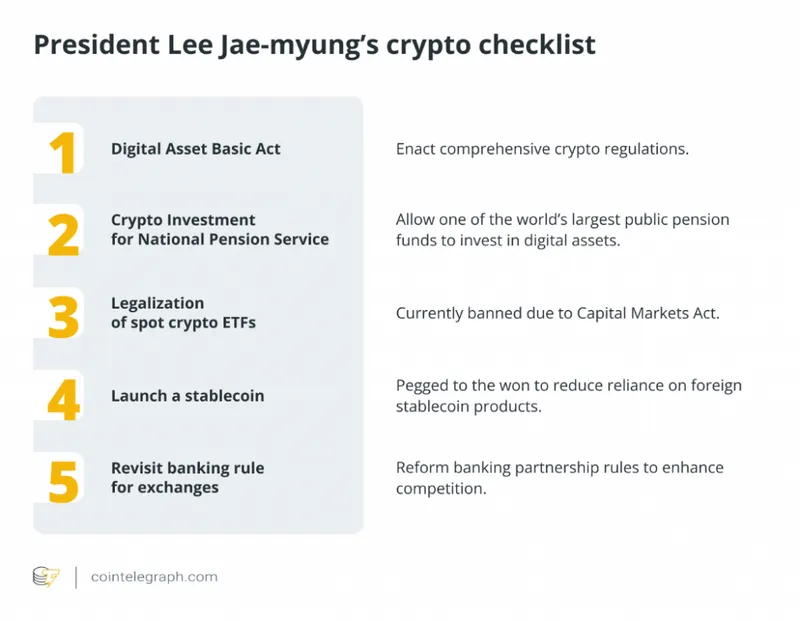

President Lee Jae-myung’s administration supports Korean stablecoin regulation allows companies with ₩500 million ($370,000) in equity capital to issue tokens. This strategic South Korea CBDC pause aligns with the stablecoin strategy and reflects political priorities.

Min Byeong-deok, head of the Digital Asset Committee, stated:

”The market for stablecoins could surpass even artificial intelligence or semiconductors.”

Democratic Party leaders view won-denominated stablecoins as essential for keeping monetary sovereignty, especially since foreign stablecoins accounted for over ₩57 trillion ($42 billion) in Q1 2025 trading volume. The South Korea CBDC pause thus plays a crucial role in reassessing monetary policies.

Also Read: SWIFT Eyes CBDC Market, But Ripple’s XRPL May Dethrone It First

The Bank of Korea digital currency research continues while monitoring won-backed stablecoin launch developments. This recent move with the South Korea’s pause with digital currencies allows evaluation of private sector solutions before resuming government digital currency efforts, and also gives regulators time to assess market conditions.