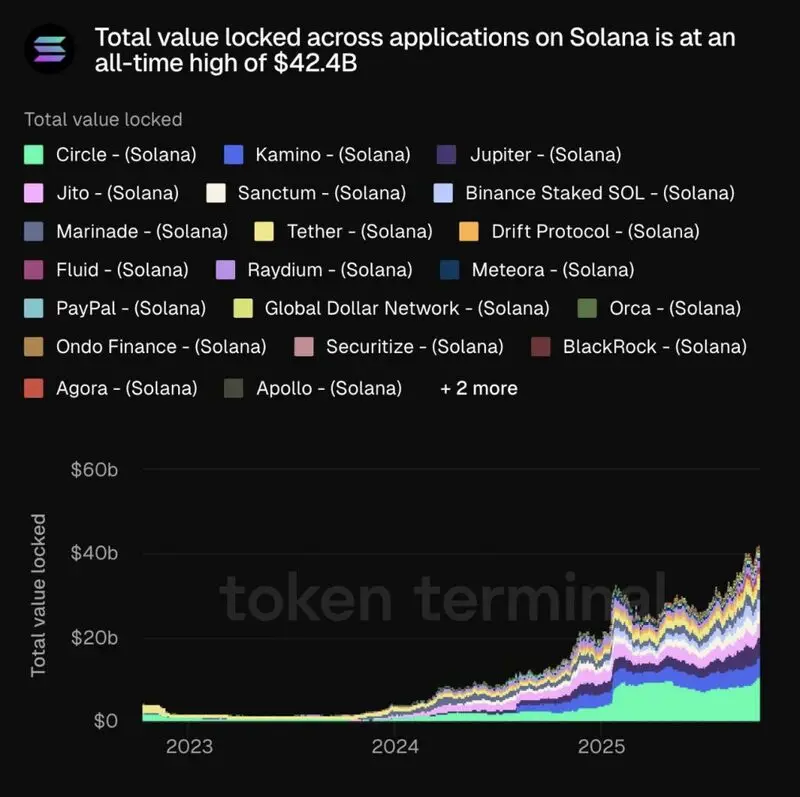

According to Token Terminal, the total value locked (TVL) across all applications on the Solana (SOL) network has hit an all-time high of $42.4 billion. The rising TVL shows the growing adoption of applications built on the SOL network. Despite the growing TVL, SOL’s price continues to slump amid a market-wide downtrend. Let’s discuss when SOL could rebound.

Will Solana Rebound After TVL Hits All-Time High?

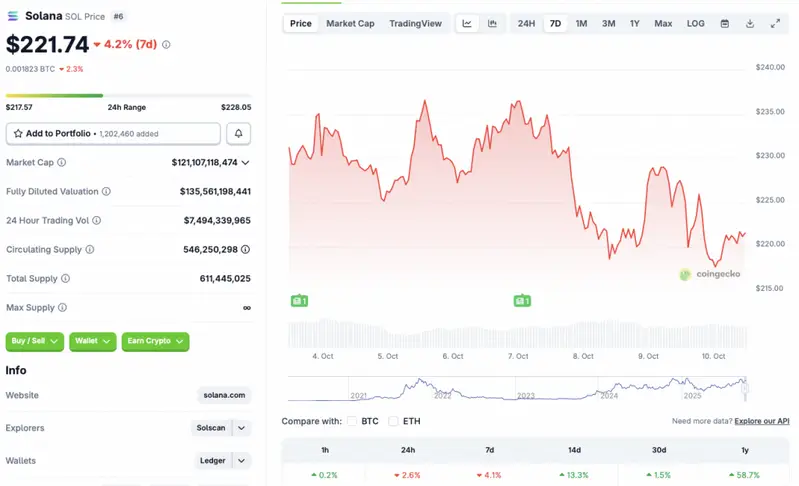

The crypto market broke into a rally earlier this month, with Bitcoin (BTC) hitting a new all-time high of $126,080. Solana (SOL) also followed the bullish trajectory, reclaiming the $236 price level. However, the rally was short-lived. The market faced a steep correction, and SOL’s price fell to the $220 price point. SOL currently faces some support at the $220 price point.

According to CoinGecko’s SOL data, Solana is down 2.6% in the last 24 hours and 4.1% over the last week. However, the asset has maintained gains in the other time frames. SOL has rallied 13.3% in the 14-day charts, 1.5% over the previous month, and 58.7% since October 2024.

There is a high chance that the crypto market will rebound over the coming weeks. October has usually been a bullish month for the crypto market. Chances are high that we will follow the historical pattern this time as well.

Moreover, the Federal Reserve is likely to introduce another interest rate cut after its next meeting. BUllish historical data and a potential interest rate cut could trigger another bull run for Solana (SOL) and the larger crypto market.

Also Read: Solana: Will SOL Surge in Q4 After Latest ETF Filing?

The US SEC is also expected to decide on spot Solana (SOL) ETF applications on Oct. 10. A positive decision could lead to a big rally for SOL. However, the SEC may even decide to postpone its final verdict.