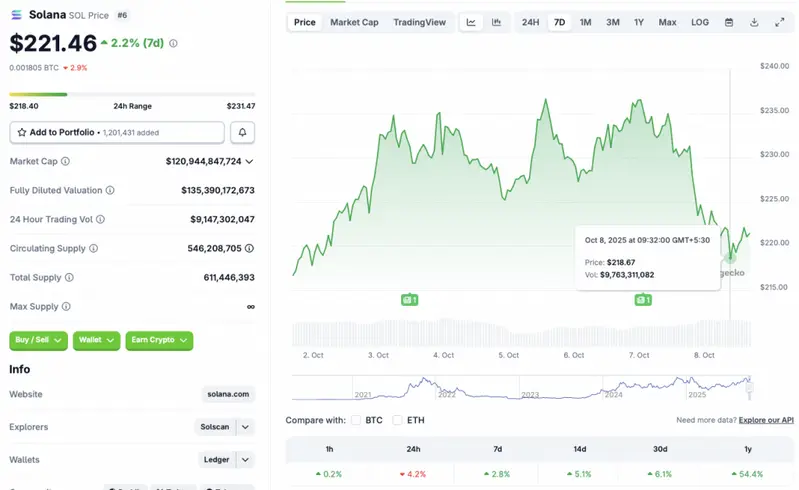

Solana (SOL) is following the market-wide correction, dipping 4.2% in the last 24 hours. However, despite the price dip, CoinGecko notes that SOL is trading in the green zone in the other time frames. SOL has ralooed 2.8% in the weekly charts, 5.1% in the 14-day charts, and 6.1% over the previous month. In this price prediction article, let’s discuss if Solana (SOL) can hold on to the $221 price level or will it dip to $200.

Solana Price Prediction: Rebound or Dip to $200?

Solana (SOL) briefly dipped to the $218 price level earlier today, but rebounded to $221. SOL seems to have some support around its current price levels. However, dipping below $215 could lead to SOL’s price facing further correction. SOL could find support at the $200 level next, if it fails to sustain its current price.

Some bullish developments in October could aid Solana’s (SOL) recovery. Firstly, October has historically been a bullish month for the crypto market. We could see the market rebound based on the historical pattern.

Secondly, there is a high chance that the Federal Reserve will roll out another 25 basis point interest rate cut after its October meeting. Another rate cut could lead to a market-wide rally. Such a development could lead to Solana (SOL) hitting a new peak.

Also Read: Solana 20% Away From New Peak: Will SOL Hit $300 in October?

Thirdly, we are getting close to the SEC’s deadline for its decision on several spot Solana ETFs. An ETF approval will likely lead to a surge in institutional inflows for SOL. Institutional money has been a key driver for the current market cycle. Bitcoin (BTC) and Ethereum (ETH) have hit new all-time highs thanks to consistent ETF inflows. Solana (SOL) could also follow a similar pattern if an ETF is approved.

However, macroeconomic challenges and trade wars could present barriers to the cryptocurrency market. Uncertainties around US economic policies have also caused investors to lose confidence.