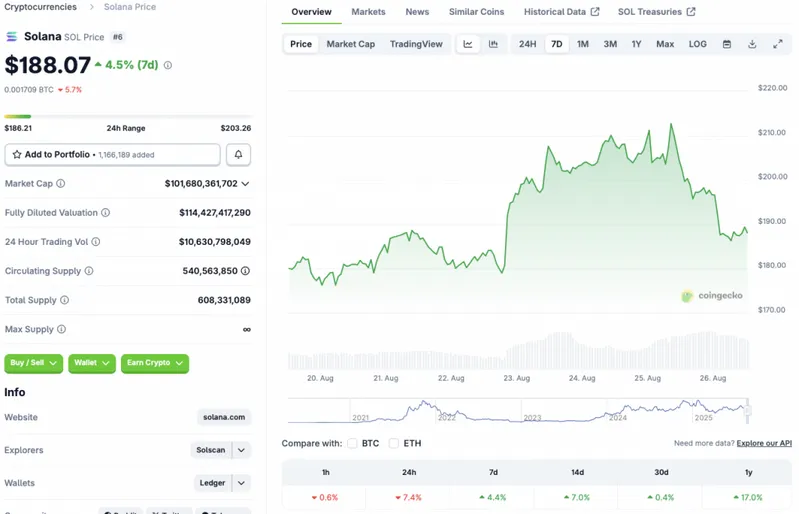

According to CoinGecko data, Solana (SOL) was down by more than 10% in the daily charts at one point. The losses have come down to 7.4% as of press time. The steep correction has reinvigorated fears of the asset going down to $175-$176, a level last traded at earlier this month. Despite the big price crash, Solana (SOL) has maintained gains in the other time frames. The asset is up 4.4% in the weekly charts, 7% in the 14-day charts, 0.4% in the monthly charts, and 17% since August 2024.

Is SOL On Its Way To a Recovery?

Solana’s latest price crash comes amid a larger market dip. Bitcoin (BTC) has fallen to the $110,000 price level and shows signs of falling further. If the current trend continues, there is a chance that SOL could slip to the $175-$176 mark.

The market-wide correction could be due to increased profit-taking as Bitcoin and Ethereum hit new all-time highs this month. The dip may have also been triggered by increased uncertainties in global economics, fuelled by President Trump’s tariffs.

Solana (SOL) is among the most resilient cryptocurrencies in the market. The asset has made quite a recovery over the last few years. SOL’s price fell to below $9 in 2022 after the collapse of FTX. Since its 2022 lows, SOL has hit multiple all-time highs. The asset’s most recent peak was $293.31, which it hit in January of this year.

Also Read: Cardano (ADA) & Solana (SOL) Price Prediction For August 31st 2025

Given Solana’s incredible history of bouncing back, there is a high chance that the asset will rebound when market conditions improve. There is a high likelihood that the Federal Reserve will announce an interest rate in September. A rate reduction will boost SOL’s chances of a trend reversal. However, September has usually been a bearish month for crypto. Both instances could cancel each other out and lead to market consolidation.