Solana (SOL) is among the top-performing cryptocurrencies in 2025, having spiked nearly 80% in a year. The altcoin is up close to 25% year-to-date and is sustainably scaling up in the indices. The investor community has remained mostly positive about SOL, as the altcoin has delivered results almost every quarter. Analysts have been reviewing Solana’s prospects, giving it an ambitious price target.

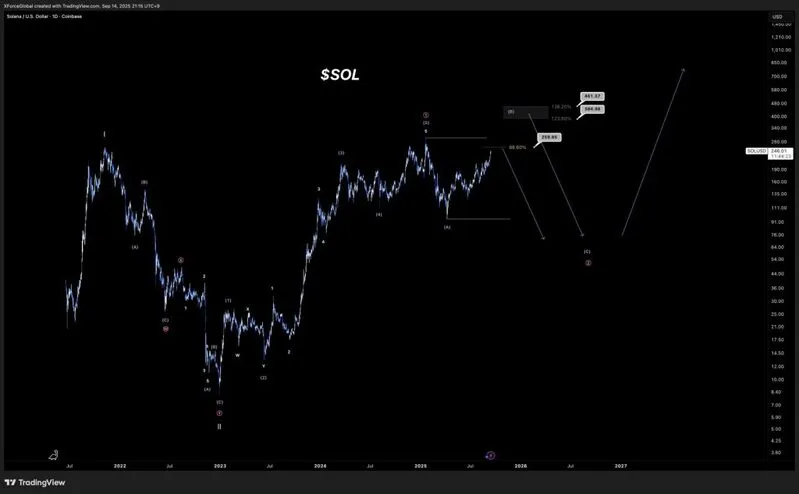

On the heels of the positive momentum, a pseudonymous cryptocurrency analyst XForceGlobal has given a bullish price target for Solana. The analyst shared a chart indicating that SOL is forming an ascending bullish triangle. He forecasted that the altcoin could be on the brink of a breakout and surge ahead in the charts. Traders could make the most if they take an entry position now, as it’s around the $230 range.

Also Read: XRP Briefly Tops Banking Giant Citigroup in Market Cap

Solana Price Target: $260, $380, and $460

The cryptocurrency analyst states that Solana’s next price target is the $260 mark. According to his price prediction, SOL could enter a consolidation phase at this level before breaking out in value. It would be an uptick and return on investment (ROI) of approximately 12% from its current price of $233.

However, the next price target for Solana is at $380, which is a bullish thesis. That’s an uptick of approximately 63% from its current price. An investment of $1,000 could turn into $1,630 if the forecast turns out to be accurate. That’s stellar returns, as not every investment can generate this much profit.

Also Read: Binance Coin Holds at $926 Despite Market Dip: $1000 Next?

In addition, the next price target for Solana after $380 level is at $460. The analyst stressed that SOL could face a major correction after it reaches the $460 mark. The correction would come as traders would initiate profit booking, leading to sell-offs. “Solana is showing three major levels of interest before a strong pullback is likely. The most probable targets to watch are $260, $380, and $460 before a major correction sets in. The RRR ratio for longs remains poor, unless additional risk is taken on through leverage,” read the forecast.