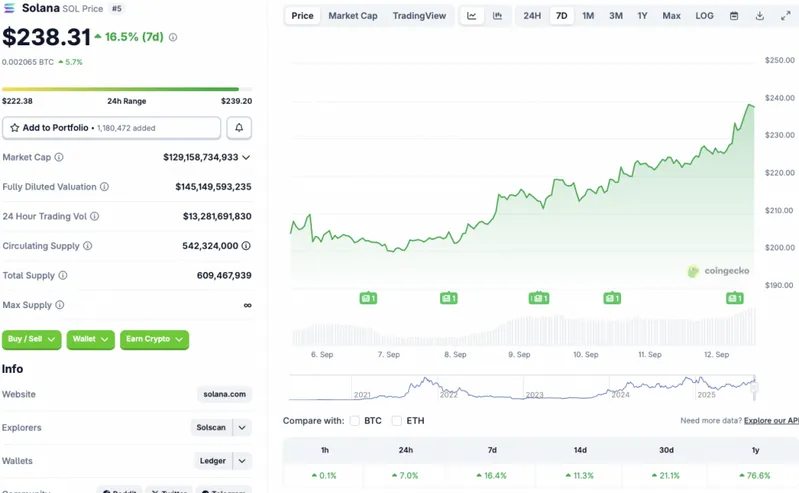

Solana (SOL) is currently one of the best-performing cryptocurrencies in the top 100 projects by market cap. The asset has outshone Bitcoin (BTC), Ethereum (ETH), and XRP, among others, in the daily and weekly charts. According to CoinGecko data, Solana (SOL) has seen a rally of 7% in the last 24 hours, 16.4% in the last week, 11.3% in the 14-day charts, and 21.1% over the previous month.

Can Solana Continue Its Rally To A New Peak Of $300?

Solana (SOL) has displayed an incredible performance over the last few years. The asset’s price fell to below $9 after the collapse of FTX in 2022. Since its 2022 lows, SOL has hit multiple all-time highs. Solana (SOL) hit its most recent peak of $293.31 on Jan. 19 of this year. If SOL reclaims its January peak, there is a very high chance that the asset will breach the $300 mark.

CoinCodex analysts anticipate Solana (SOL) to move in a sideways pattern over the coming weeks. The platform predicts SOL will rally to $262.26 on Nov. 23, but does not expect it to hit a new all-time high anytime soon. Hitting $262.26 from current price levels will entail a rally of about 10%.

Other factors could aid Solana’s (SOL) attempts to crack the $300 price level. There is a very high chance of an interest rate cut later this month. The cooling inflation numbers have further increased the chances of an interest rate cut in the US. A rate cut may lead to a spike in risky investments. The crypto market could benefit under such conditions.

There is also a high chance that we will get a spot Solana (SOL) ETF this year. An ETF approval from the SEC will likely lead to a surge in institutional inflows. Such a development will also greatly help Solana’s (SOL) price.

Also Read: SOL Strategies Becomes First Solana Treasury to List on Nasdaq

Both an interest rate cut and an ETF approval could boost investor confidence in Solana (SOL). Both developments could even push SOL’s price beyond the $300 mark.