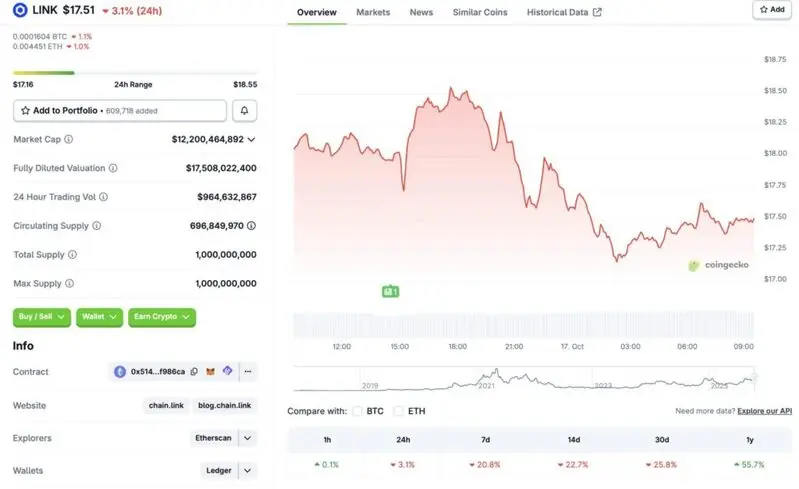

Chainlink (LINK) has faced a substantial price crash over the last few days. LINK’s downtrend follows a market-wide pattern, with Bitcoin (BTC) falling below the $110,000 price level. According to CoinGecko data, LINK’s price has dipped by 3.1% in the last 24 hours, 20.8% in the last week, 22.7% in the 14-day charts, and 25.8% over the previous month.

Should You Be Worried About Chainlink’s Massive Price Crash?

The current market crash could be due to heightened investor worry. The market faced its most significant single-day liquidation ever earlier this month. The dip was triggered by a spat between the US and China, with both parties threatening trade blockages. The market recovered after positive developments at the negotiating table. However, investor sentiment is still low. Chainlink (LINK) and other assets continue to see big outflows. According to CoinGlass data, $717.76 million was liquidated from the crypto market in the last 24 hours.

Chainlink (LINK) is currently following Bitcoin’s (BTC) trajectory. LINK’s price could recover if BTC rebounds. BTC’s price path could pick up steam after a potential interest rate cut later this month. In a recent speech, Federal Reserve Chair Jerome Powell hinted that lowering rates may be inevitable. This would mark the second interest rate cut in 2025. Such a development could lead to a spike in risky investments, such as Chainlink (LINK) and other altcoins.

Also Read: Chainlink: What Does a $1,000 LINK Investment Earn You in 2026

However, there is also a possibility that Chainlink (LINK) will consolidate around current levels. The crypto market is still dipping, and recovery may take longer than expected. September’s interest rate cut led to a slight rally, but ended with a market crash. A similar pattern could emerge after the second rate cut as well. Market volatility is still high, and prices could move in either direction. How things unfold is yet to be seen.