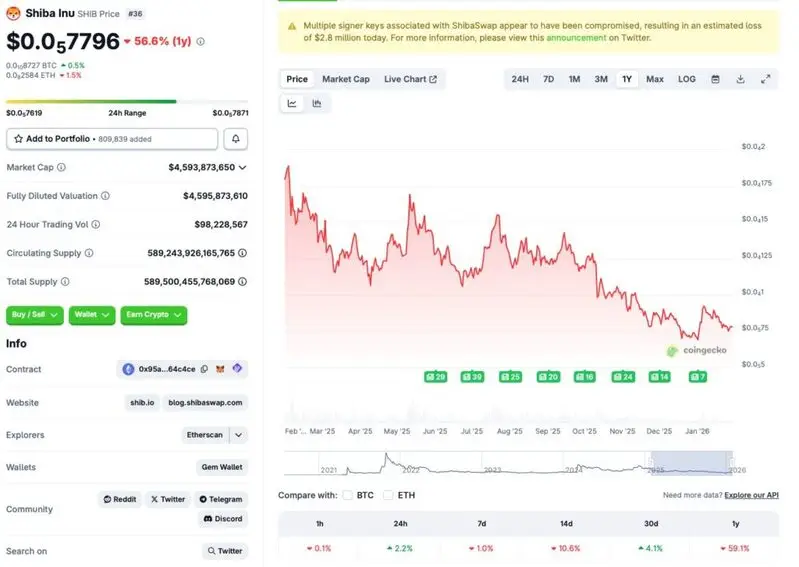

Shiba Inu (SHIB) has seen a gradual decline in its rankings among the top crypto projects by market cap. A dip in price has led to a dip in the project’s valuation, which has slipped to the 36th position, according to CoinGecko’s SHIB statistics. SHIB’s price has fallen by nearly 60% since January of 2025, and its market cap has dipped to $4.59 billion. However, reclaiming the $0.00001528 price level could push SHIB’s rankings back into the top 20. In this price prediction article, let’s discuss when Shiba Inu (SHIB) could climb to the $0.00001500 level once again.

Shiba Inu Price Prediction: Is $0.00001500 In The Cards For February 2026?

Shiba Inu (SHIB) last traded above the $0.00001500 mark in July of 2025. Moreover, the asset’s price gained an additional zero after the decimal point in October, which it has yet to get rid of. In fact, SHIB’s price has struggled to gain steam since December 2024, when it climbed to $0.00003.

Shiba Inu (SHIB) is a memecoin and carries a lot of risk. The current market environment is such that investors are staying away from risky assets, preferring safe havens such as gold and silver. The bearish sentiment could present substantial challenges to SHIB’s chances of reclaiming the $0.00001500 price level. Macroeconomic uncertainties and geopolitical tensions may further bar the asset from any positive price action.

CoinCodex analysts also don’t paint a bullish picture for Shiba Inu (SHIB). The platform anticipates SHIB to rally to $0.000009211 on April 10, but does not expect the memecoin to hit $0.000015 anytime soon.

Also Read: What Happens if You Invest $1,000 in Shiba Inu & Forget for 10 Years?

While Shiba Inu (SHIB) continues to boast substantial clout in the cryptocurrency space, the project has lost significant steam over the last year. The coin could see some relief in the event of an interest rate announcement from the US Federal Reserve.