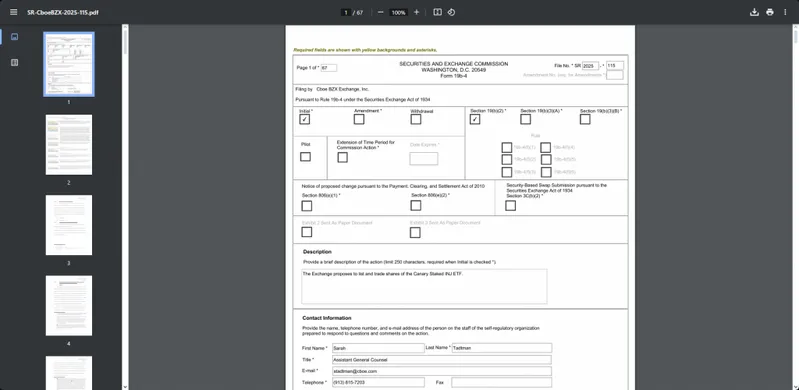

A staked Injective ETF from Canary Capital has entered the SEC’s 21-day public comment period right now, and this marks the first regulatory review of an institutional staking crypto ETF approval. The securities watchdog is seeking public input on the Canary staked INJ fund, which would provide institutional access to staking rewards through regulated investment products.

🚨 UPDATE: The SEC acknowledges filing for Canary Capital’s Staked $INJ ETF. pic.twitter.com/xb3l2fGIon

— Cointelegraph (@Cointelegraph) August 26, 2025

Staked Injective ETF: Canary’s Groundbreaking Opportunity for Institutional Yield

The SEC public comment ETF process represents a breakthrough for the staked Injective ETF category, even though the approval isn’t guaranteed at this point. Canary’s proposal demonstrates how institutional access to staking can actually work within regulated frameworks, along with the fund actively staking INJ holdings to generate rewards for shareholders.

The exchange stated:

“The geographically diverse and continuous nature of INJ trading makes it difficult and prohibitively costly to manipulate the price of INJ and, in many instances, the INJ market can be less susceptible to manipulation than the equity, fixed income, and commodity futures markets.”

Also Read: Grayscale Files Avalanche ETF With SEC, Signaling Crypto Growth

Regulatory Path for Staked Injective ETF

The staked Injective ETF benefits from some recent SEC guidance that clarified most proof-of-stake features don’t fall under securities laws. This regulatory clarity enables Canary’s staked INJ fund to operate within compliance frameworks while delivering institutional access to staking yields, though the process is still being reviewed.

Market Impact and What’s Next

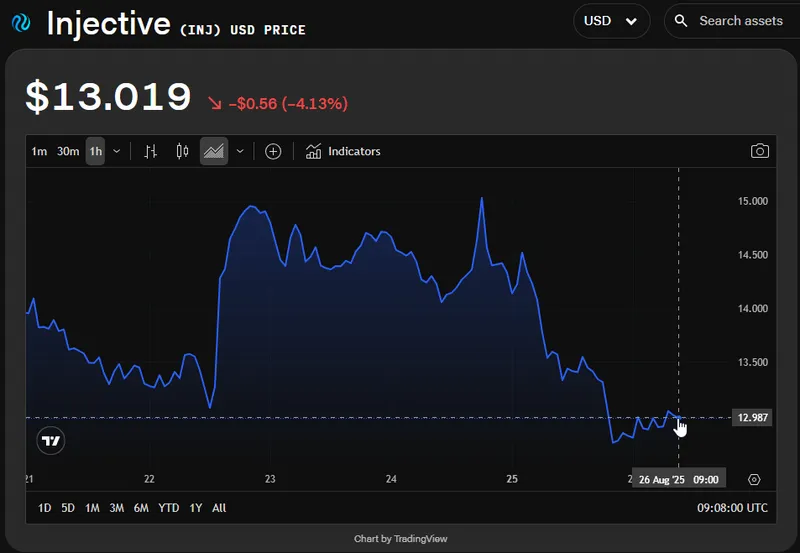

The staked Injective ETF proposal comes as INJ trades at $13.007 with a $1.3 billion market cap, and the token has been facing some pressure recently. The SEC has up to 90 days to decide on Canary’s staked INJ fund following the comment period that’s happening right now.

Also Read: SEC Delays XRP, SOL, LTC ETFs Until October 2025: Approval Still in Play

If the SEC approves it, the Canary staked INJ fund will trade on Cboe BZX Exchange, establishing a precedent for staking crypto ETF approval products. This represents a significant step toward bringing institutional access to staking rewards through regulated investment vehicles, even as the crypto market continues evolving.