The groundbreaking Bitcoin-Ethereum ETF approval by the SEC is not just being widely celebrated. It’s fundamentally reshaping crypto investment availability. The Bitwise fund, which was dramatically approved in an astonishingly quick 45-day timeline, is well organized to offer direct exposure to both Bitcoin and Ethereum in a single investment vehicle. Market data is being intensively monitored across exchanges. Meanwhile, prices are strictly tracked in real time.

News but expected. Even Gensler’s SEC would approve these. That said, they approved in 45 days vs waiting 240 days. I really want to interpret this as a sign the new SEC will be faster but no way to know really. Litecoin on deck, know more soon https://t.co/xqlXusHuyN

— Eric Balchunas (@EricBalchunas) January 31, 2025

This revolutionary development has been warmly received by market analysts. Longstanding concerns about crypto market volatility are now being effectively addressed through the fund’s robust regulatory framework. Institutional investors are finally being orderly provided with a thoroughly vetted investment pathway. Digital assets are carefully protected under Coinbase’s battle-tested custody infrastructure, including assets from the new Bitcoin-Ethereum ETF.

Also Read: Shiba Inu Holders Demand a Solana Bridge: A Collaboration Underway?

How Bitcoin and Ethereum ETFs Impact Crypto Market Volatility and Investments

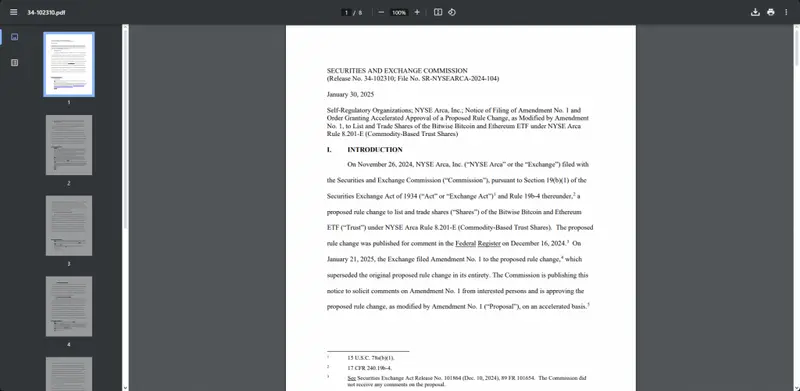

Unprecedented Approval Timeline and Structure

Bitwise’s hybrid ETF, therefore, received expedited approval for listing on NYSE Arca.Bloomberg senior ETF analyst Eric Balchunas noted, “I really want to interpret this as a sign the new SEC will be faster, but no way to know really.” The fund’s composition mirrors market capitalization, with 83% Bitcoin and 17% Ethereum distribution. This makes it a strong Bitcoin-Ethereum ETF.

Market Response and Price Movement

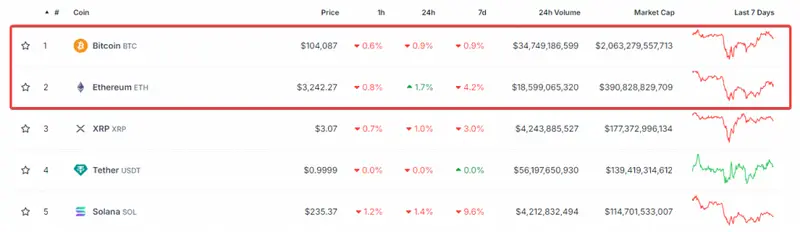

Bitcoin surges at $104,087, while Ethereum holds firmly at $3,242.27. Consequently, market sentiment is overwhelmingly optimistic following the ETF’s historic approval. In fact, a mammoth $34 billion in Bitcoin and $18 billion in Ethereum are being intensely traded across the market. Moreover, trading volumes are carefully tracked across premier global exchanges, ensuring accurate and real-time market data. As a result, the crypto investment landscape has been revolutionized. Furthermore, institutional capital is now being organized through iron-clad regulated vehicles. In addition, security concerns are thoroughly obliterated through military-grade custody solutions, which are flawlessly executed under Coinbase’s institutional fortress, especially for the Bitcoin-Ethereum ETF safekeeping.

Also Read: XRP’s Big Leap: ETF Approval & $423K AMM Liquidity Surge—What’s Next?

Regulatory Shift and Industry Impact

Can Trump’s Executive Order Break Crypto’s Four-Year Cycle?

— Bitwise (@BitwiseInvest) January 30, 2025

With Washington embracing digital assets like never before, the impact of this shift could extend the current bull run into 2026 and beyond.

The path to full mainstream crypto adoption is clearer than ever. pic.twitter.com/n2c9AdM2Yw

The SEC’s approval aligns with some of the recent permissions for crypto investment products. This includes Nasdaq and Cboe BZX’s listing of Hashdex and Franklin Templeton ETFs. Bitwise’s strategic expansion includes applications for various crypto ETFs like the Bitcoin-Ethereum ETF. This demonstrates growing institutional interest.

Future Outlook and Market Implications

Bitwise has spearheaded analysis showing how the transformative regulatory environment could catalyze market growth beyond 2026. Multiple strategic calculations inform the fund’s daily NAV. It is engineered at 4:00 p.m. ET through various major data feeds from premier global exchanges. That said, through several key innovations, custom pricing mechanisms have been architected for investors.

Also Read: Dogecoin Weekend Price Prediction: DOGE Eyes $0.36 In A Fresh New Ascent

These leverage numerous significant market benchmarks for real-time value optimization. Market performance analysis has been instituted across various time zones. Meanwhile, trading volumes are systematically optimized to maximize price discovery efficiency. The pioneering 83:17 ratio between Bitcoin and Ethereum in the Bitcoin-Ethereum ETF is strategically maintained through multiple essential rebalancing protocols. These have been engineered to revolutionize market consistent capitalization.