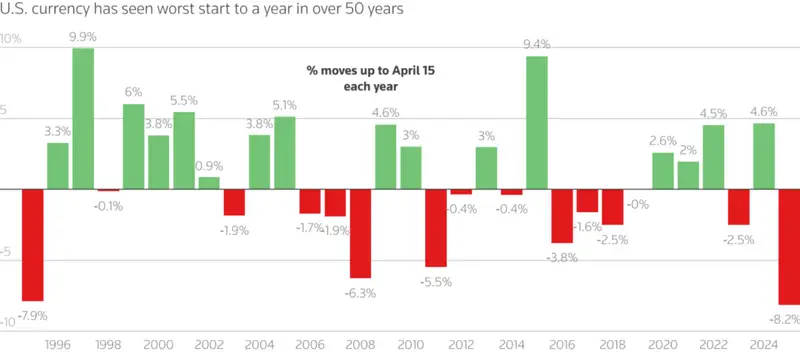

Scope’s U.S. dollar downgrade warning has actually rattled global markets as America’s currency is suffering its worst decline in 50 years. European rating agency Scope has indicated that the U.S. could face credit downgrades amid growing trade tensions and also rising currency risk. The dollar has fallen by around 8.2% against major currencies this year, which is prompting some serious concerns about U.S. economy recession possibilities and, well, the future of dollar dominance in general.

Also Read: What is Julie Banderas Net Worth in 2025: Salary, Assets & Hidden Wealth

Understanding Scope’s U.S. Dollar Downgrade Warning and What It Means for Your Investments

Rating Agency Issues Stark Warning

Berlin-based Scope, which is used alongside S&P Global, Moody’s and Fitch by the European Central Bank, currently rates the U.S. at AA with a “negative” outlook. This rating actually sits below the AA+ scores from S&P and Fitch, while Moody’s remains the only major agency still giving America a top-grade “triple A.”

Scope’s head of sovereign ratings, Alvise Lennkh-Yunus, stated:

“If doubts about the exceptional status of the dollar were to increase, this would be very credit negative for the U.S.”

Also Read: Throwback: How A Store Manager Made $1 Million With Shiba Inu

The U.S. dollar downgrade warning represents the first time an agency has delivered such a stark assessment following President Trump’s shake-up of post-World War II economic structures. And credit default swap markets are currently pricing in as many as five U.S. rating downgrades, which is pretty concerning for investors.

The report identified the United States as one of the countries most exposed to the trade war, especially in some extreme scenarios. These include a prolonged tariff battle or the introduction of U.S. capital controls, which could have far-reaching consequences.

Trade War Consequences and Currency Risk

Lennkh-Yunus said:

“These developments are unlikely to happen swiftly.”

The currency risk extends well beyond American borders right now. Countries that are particularly vulnerable include open economies like Ireland, nations sensitive to higher financing rates such as Italy, oil exporters, and also countries with weak currencies like Turkey and Georgia.

Also Read: US Dollar Struggles While Ruble Rises 38%—Is a New Economic Order Coming?

The U.S. dollar downgrade could accelerate if China and the European Union deepen their trade relationships in the coming months. Additionally, if China continues opening its economy and the EU convinces its citizens to invest more in the bloc’s priority projects, the dollar’s position might weaken further.

Scope’s report said:

“The eventual impact on growth, inflation, public debt, external credit metrics and thus sovereign credit ratings, will ultimately depend on the macro-economic environment.”

Long-Term Implications for Global Finance

U.S. economy recession fears have intensified with these developments lately. As investors are reassessing traditional safe-haven assets, markets remain quite volatile. The currency risk has increased dramatically, forcing financial institutions to reconsider long-held assumptions about global economic stability.

With credit markets signaling potential downgrades and the dollar experiencing historic weakness, investors should pay close attention to these developments. Scope’s U.S. dollar downgrade warning serves as an important indicator of shifting economic power dynamics and highlights the challenges facing America’s financial standing in today’s uncertain global environment.

Also Read: De-Dollarization: 9 Countries Ditch the US Dollar