De-dollarization drives Russia’s current economic changes. To counter sanctions, Russia uses asset tokenization and new payment methods. These steps affect global trade and market prices. The Bank of Russia leads these changes, impacting gas prices and international money flows.

Also Read: Dogecoin To Hit $0.82: Doge To Surge 120%, Here’s When

The Role of Tokenization in Russia’s Push Against Western Sanctions and De-dollarization

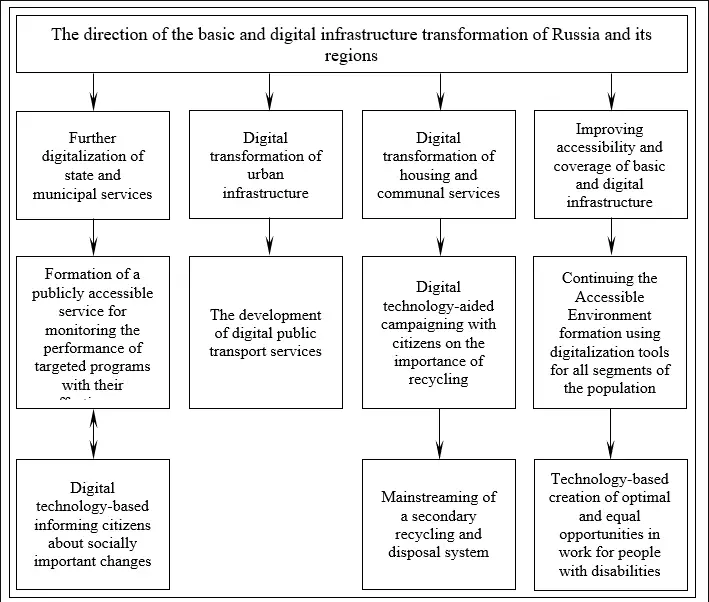

Legal Framework Development

The Bank of Russia takes a careful approach to asset tokenization. Its rules are still being written. The central bank’s November report states, “The digital rights framework is most suitable for tokens in Russian legislation,” enabling various rights to be digitized. This tokenization of assets opens new market options. Tax rules remain unclear, making investors cautious.

Impact on Gas Markets

Russian sanctions have changed how energy is traded. U.S. sanctions on Gazprombank might disrupt payments for Russian oil and gas. European countries face higher gas prices as they switch to new payment systems. EU data shows they bought over €10 billion in Russian gas from January to September 2024.

Also Read: Top 3 Cryptocurrencies That May Hit All-Time Highs in December

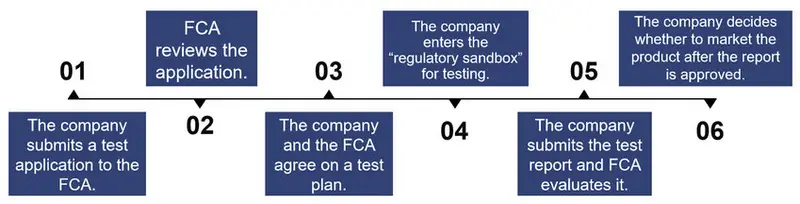

Testing Through Regulatory Sandbox

Russia’s economic strategy involves testing new technology in controlled settings. The central bank created a space for tokenization and wants public feedback until December 27, 2024. This careful testing supports the country’s de-dollarization plans while limiting risks.

International Response and Market Effects

European nations react differently to Russia’s financial changes. Hungary keeps its gas agreements despite sanctions. Italy, Greece, and Slovakia buy more Russian gas. These actions show how Russian sanctions shape regional trade patterns.

Also Read: Joe Rogan Eyes This Job If Elon Musk Buys MSNBC

The Bank of Russia uses asset tokenization as part of its de-dollarization plan, responding to Western sanctions. Its success depends on new rules and global markets. Payment systems keep changing as countries adapt their economic strategies.