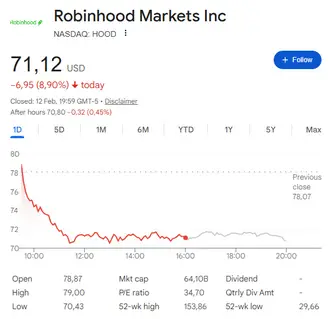

Robinhood shares are taking a drastic blow today and investors are having to deal with a deep selloff since the last Robinhood earnings announcement. The fourth-quarter performance of the trading platform showed dismal cryptocurrency sales of only $221 million, a 38 percent decline on a year-over-year basis and below analyst forecasts by approximately 27 million. As of the date of this writing, Robinhood stock is currently trading at 71.12, which is almost half of the October 2025 high. Wall Street analysts are split on whether this is a Robinhood stock buy opportunity, but the Robinhood stock forecast shows it could be a good stock in the future to those who can afford the volatility.

Also Read: Dow Jones Stock Markets Futures Jump as CPI Test Nears

HOOD Stock: Earnings Miss Shakes Investor Confidence

Crypto Winter Takes Toll on Revenue Performance

The company released its earnings report on February 10, showing total revenue of $1.28 billion, which represents a 27% year-over-year increase but fell short of the $1.32 billion analysts expected. Cryptocurrency revenue served as the primary drag on performance, coming in at $221 million and representing a 38% decline compared to the same period last year. Bitcoin’s 23% year-to-date plunge in 2026 has impacted the platform significantly, with crypto accounting for roughly 20% of total revenue right now.

Shiv Verma, the company’s Chief Financial Officer had this to say:

“2025 was a record year where we set new highs for net deposits, Gold Subscribers, trading volumes, revenues, and profits, and we closed the year with a strong Q4. 2026 is off to a good start, and we are incredibly excited about our plan and momentum for the year ahead as we focus on shipping great products for customers and driving profitable growth for shareholders.”

Despite the crypto miss, earnings per share beat expectations at 66 cents versus the 63 cents analysts predicted. The figure fell 35% year-over-year, though a 47-cent tax benefit inflated Q4 2024 results, so the comparison isn’t exactly apples to apples.

Stock Faces Heavy Market Pressure

Robinhood stock today trades down 8.79% at the time of writing, and the selloff has intensified since the start of 2026. Investors are growing increasingly concerned about the platform’s dependence on volatile crypto and equity markets. Transaction-based revenue from options, equities, and also crypto made up 52% of total revenue in 2025, which makes the company particularly vulnerable to market downturns.

Wednesday’s selloff saw shares plummet as much as 13% during trading, extending a nearly 34% decline since the start of 2026. Robinhood stock today has fallen almost 50% from its all-time high closing price, raising questions about whether current levels represent an attractive entry point.

Analysis Shows Path to Potential Recovery

Robinhood stock price analysis from Wall Street reveals a consensus price target near $127, implying around 64% upside from current levels right now. Several analysts lowered their targets by 10% to 20% after the Robinhood earnings report dropped, but the average of recently updated targets stands at approximately $134, suggesting potential gains of roughly 72% for investors willing to hold through volatility.

Full-year 2025 revenue grew an impressive 52%, while adjusted operating expenses and share-based compensation increased just 22%. The company’s adjusted EBITDA margin reached 56.4%, up 800 basis points compared to 2024. Net deposits surged 35% as customers continued adding funds, and management targets over 20% net deposit growth for 2026.

The CFO also emphasized the company’s strategic priorities:

“First, we want to win with active traders. Second, we want to win in the wallet share. Third, we want to be global and we want to be institutional.”

Buy Opportunity or Falling Knife?

The question on investors’ minds right now is whether Robinhood stock today represents a Robinhood stock buy opportunity after its massive selloff. Prediction markets have doubled trading volumes in Q4, and the company calls this their top growth priority going forward. Options trading revenue has also risen for nine consecutive quarters.

Also Read: Alphabet (GOOGL): Waymo to Help Stock Rebound?

However, risks remain substantial for Robinhood stock today. Ongoing crypto market weakness and also potential Federal Reserve rate cuts could pressure net interest revenue down the line. The company’s exposure to transaction-based revenue means continued weakness in crypto and equity markets will likely impact performance further.

CEO Vlad Tenev emphasized the company’s competitive positioning. He said:

“We want active traders to feel like they are at a disadvantage trading anywhere but Robinhood Markets, Inc.”

For those considering a Robinhood stock buy, Robinood stock price analysis suggests the $60 to $75 range may offer an accumulation zone for long-term investors. The earnings report showed solid fundamentals, including record funded accounts and Robinhood Gold subscribers reaching 4.2 million.