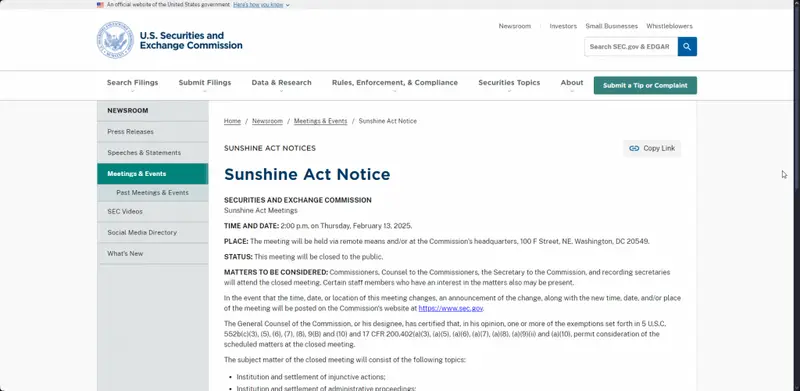

The Ripple vs SEC case reaches a critical juncture as the Securities and Exchange Commission convenes a crucial closed-door meeting on February 13, 2025. The highly anticipated session under the Sunshine Act could potentially end the SEC Ripple lawsuit. This lawsuit has dominated cryptocurrency regulations since December 2020. With XRP’s price climbing several percentage points to $2.48 and multiple trading indicators turning positive, various investors closely monitor the numerous possibilities surrounding a Ripple SEC settlement.

Also Read: Official Trump (TRUMP) & Melania (MELANIA) Price Prediction For February End 2025

Ripple Lawsuit, SEC Settlement Talks, and Legal Impact on Cryptocurrency

Critical Meeting Details

Numerous crypto experts see the SEC’s decision on the Ripple lawsuit as a potential game-changer for several digital asset regulations. A withdrawal of the SEC’s appeal in the Ripple vs SEC case could spark multiple waves of institutional adoption. It might also fire up various discussions about that potential Ripple IPO – something several company leaders have been hinting at.

Market Impact and Future Implications

Recent court decisions in the Ripple SEC case outcome was in favor of the blockchain company, particularly regarding secondary XRP sales. Several major asset managers are on high alert for regulatory updates, and so are we. Financial institutions are already drafting some plans for the XRP-based ETFs. A settlement here could knock down various roadblocks holding Ripple back. This could also contribute to a spark with massive price action across a large number of cryptocurrency markets.

Also Read: Warren Buffett Buys $35 Million Worth Occidental Petroleum (OXY) Stocks

Global Regulatory Perspective

The Ripple vs SEC battle influences global markets as the UK, UAE, and Singapore implement structured cryptocurrency policies. The SEC Ripple settlement talks occur amid increasing pressure for clearer digital asset guidelines. Some blockchain firms are already relocating to more favorable jurisdictions.

Settlement Prospects and Future Outlook

The SEC’s decision on the Ripple lawsuit could mark a turning point for cryptocurrency regulation. A withdrawal of the SEC’s appeal in the Ripple vs SEC case might accelerate institutional adoption. It could revive discussions about a potential Ripple IPO, previously suggested by the company’s leadership.

CEO Brad Garlinghouse had this to say:

“Legal certainty could revive discussions on a Ripple initial public offering.”

Also Read: Shiba Inu (SHIB) & Dogecoin (DOGE) Price Prediction For February End 2025

Market Response

The Ripple SEC case outcome continues to shape some of the various investor strategies and also the broader market sentiment. The potential settlement could establish several precedents for future enforcement actions. It might transform how digital assets are regulated and traded across numerous U.S. markets. Asset managers and institutional investors stand ready to enter the XRP market once regulatory clarity emerges from the Ripple vs SEC resolution. Fingers crossed!