RGTI stock options activity has actually exploded with unusual volume patterns right now as traders are positioning for potential moves in Rigetti Computing shares, as Yahoo Finance reveals. Even though there was a 1.18% decline, options traders are showing mixed sentiment with calls outpacing puts at a 0.35 ratio, which signals underlying optimism about the quantum computing stock’s prospects.

RGTI Stock Options, Price Analysis, and Tech Momentum Uncovered

Unusual Options Volume Drives RGTI Stock Options Activity

Recent RGTI stock options activity shows around 94,000 contracts were traded with calls significantly leading puts, creating a put/call ratio of 0.35 compared to the typical 0.4 level. This unusual options volume indicates heightened trader interest even despite the stock’s recent price weakness.

Implied volatility was dropped by 6.38 points to 99.91, sitting in the bottom quartile of the past year while pricing in an expected daily move of about $1.00. The options market reflects mixed sentiment as traders are evaluating Rigetti Computing’s technological advances against near-term market pressures.

Rigetti Computing Forecast Shows Strong Analyst Support

The Rigetti Computing forecast remains overwhelmingly positive right now with seven analysts maintaining “Strong Buy” ratings and zero “Sell” recommendations. B. Riley recently raised their price target to $19 from $15, which represents the street-high target for RGTI shares.

Wall Street’s consensus target of $16.20 actually suggests significant upside potential from current levels, along with the highest forecast reaching $19.00. This optimistic Rigetti Computing forecast is backed by the company’s $575 million cash position and debt-free balance sheet.

Also Read: Rigetti Computing Has Risen 1400% In 1 Year: Should You Buy?

RGTI Share Price Analysis Reveals Key Technical Levels

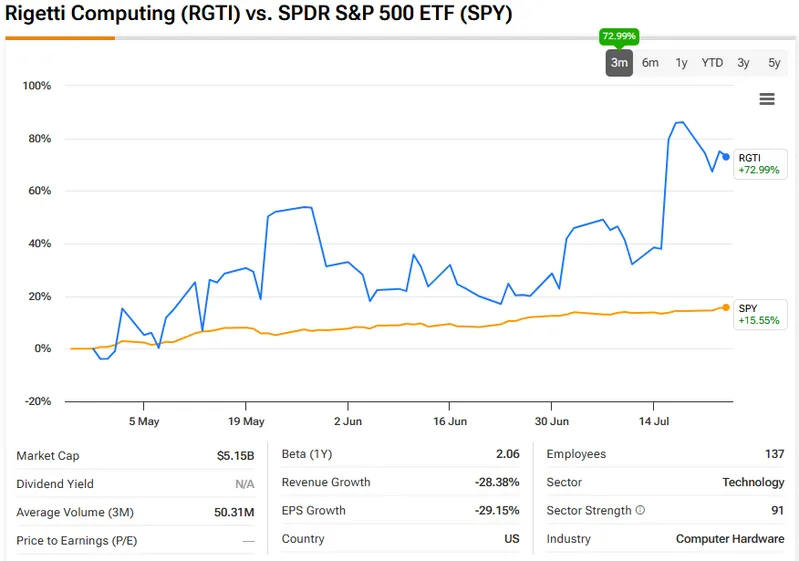

RGTI share price analysis shows the stock trading around $12.72 with critical support at $12.50-$12.70 and resistance near $14.24. The recent pullback has created what analysts view as an attractive entry point for quantum computing exposure right now.

Technical indicators are showing mixed signals with the MACD turning positive while RSI remains neutral at 53.92. The stock’s movement above its 50-day moving average suggests potential for continued tech stock momentum even despite short-term volatility.

The company’s 84-qubit Ankaa-3 system achieving 99.5% two-qubit gate fidelity strengthens the technical foundation supporting current RGTI share price analysis projections.

Tech Stock Momentum Builds in Quantum Computing Sector

Tech stock momentum has increasingly focused on quantum computing as government contracts and partnerships are validating the industry’s commercial potential. RGTI recently secured a £3.5 million Innovate UK grant along with a $5.5 million Air Force contract, demonstrating growing institutional support.

The quantum computing sector’s projected growth supports continued tech stock momentum, with Rigetti’s partnerships including a $35 million deal with Quanta Computer providing revenue visibility and market validation.

Also Read: Rigetti Computing (RGTI) Climbs on Quantum Surge

Even despite recent volatility, RGTI stock options activity continues reflecting institutional interest in the quantum computing pioneer’s long-term prospects, supported by substantial cash reserves and technological leadership in superconducting quantum processors.