According to a report by Bitwise, a total of 27 public companies currently hold Ethereum (ETH). The 27 firms collectively hold 4.63 million ETH, valued at $19 billion. The most interesting aspect of Bitwise’s report is that 95% of all the ETH held by public companies was bought in the last three months.

Did Public Companies Drive Ethereum’s Price Rally?

Corporate buying has been a key driver in the current market cycle. The 95% increase in public company holdings in the last quarter aligns with Ethereum hitting a new all-time high of $4,946.05 on Aug. 24 of this year. ETH climbed to a new peak after nearly four years. While Bitcoin (BTC) has hit multiple all-time highs after the SEC approved 11 spot ETFs, ETH has been slow to join the party.

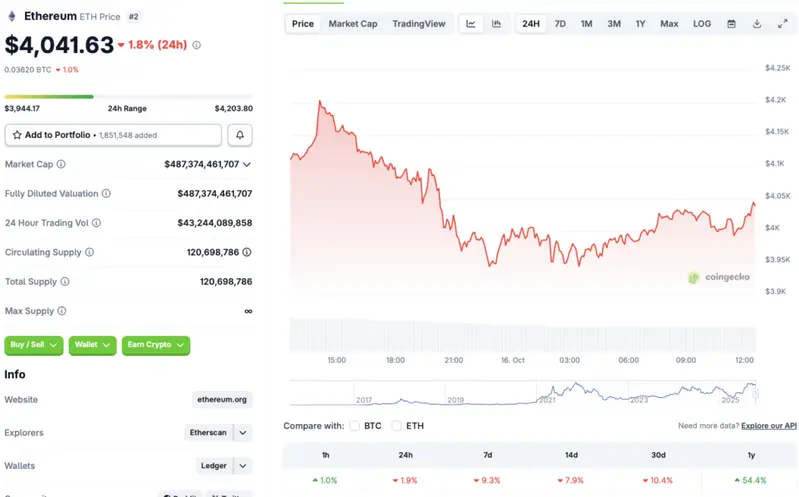

Despite the incredible rally over the last few months, Ethereum (ETH) seems to have fallen victim to the market downtrend. According to CoinGecko’s Ethereum data, ETH’s price is down 1.9% in the last 24 hours, 9.3% in the last week, 7.9% in the 14-day charts, and 10.4% over the previous month.

Will The Asset Recover This Month?

The crypto market crash was most likely triggered by trade disputes between the US and China. Macroeconomic uncertainties have led to a substantial dip in investor confidence. However, with negotiations underway, there is a chance that Ethereum and the larger market will rebound soon.

There is also a very high chance that the Federal Reserve will cut interest rates by another 25 basis points after its next meeting. A further drop in interest rates could give Ethereum (ETH) the necessary push to reclaim its peak price levels.

Also Read: Ethereum Price: $11K Move Is Coming Fast, Plan Your Returns Now

CoinCodex analysts also anticipate Ethereum (ETH) to recover soon. The platform anticipates ETH to climb to a new all-time high and breach the $6000 mark later this year. CoinCodex predicts ETH will trade at $6414 by Dec. 31, 2025.