Iran’s Strait of Hormuz tensions have reached a critical point as former Iranian Economy Minister Ehsan Khandouzi called for Iranian control over the world’s most vital oil transit route. Iran’s Strait of Hormuz handles 20% of global oil shipments, and any disruption could trigger an oil price surge toward $130 per barrel.

Also Read: Iranian Crypto Exchange Hacked for $81.7 Million by Pro-Israel Group

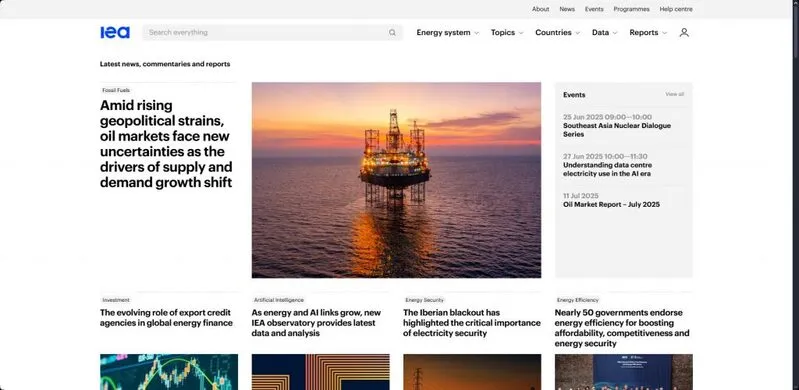

Iran Strait of Hormuz Threat Could Trigger Oil Price Surge and Supply Risks

Former Iranian Economy Minister Ehsan Khandouzi stated that tankers and LNG cargoes should only transit the Iran Strait of Hormuz with Iranian permission, implementing this policy “from tomorrow for a hundred days.” This Iran oil export threat comes as Middle East geopolitical tension escalates following Israel’s air strikes on Iran.

Khandouzi posted on X:

“This policy [of controlling maritime transit in the Strait] is decisive if implemented on time. Any delay in carrying it out means prolonging war inside the country.”

Critical Energy Chokepoint

The Iran Strait of Hormuz represents the world’s most important oil chokepoint, with approximately 20 million barrels passing through daily. This global oil supply risk affects 30% of seaborne oil transport and 20% of global LNG trade, primarily from Qatar.

ING commodity experts Ewa Manthey and Warren Patterson noted:

“Similar to Oil, the biggest concern is that a further escalation would disrupt the Strait of Hormuz. Any disruptions to shipping through the Strait of Hormuz would also have a significant impact on the global LNG market.”

They added:

“Qatar, which makes up around 20% of global LNG trade, uses this route to export LNG. There is no alternative route. This would leave the global LNG market extremely tight, pushing European Gas prices significantly higher.”

Market Impact Analysis

Energy analysts warn this Iran oil export threat could cause crude oil prices to soar above $120-150 per barrel. The oil price surge would create cascading global effects, as Deutsche Bank notes that Gulf oil is “geographically concentrated and trapped in a single access point.”

Despite mounting Middle East geopolitical tension, markets remain relatively calm with Brent crude under $74. However, the Iran Strait of Hormuz situation represents a permanent global oil supply risk that could destabilize energy markets if Tehran follows through on these unprecedented threats.

Also Read: Iran’s Sepah Hack Is a Wake-Up Call—Bitcoin Cannot Be Erased

The strategic waterway remains both vital for global energy flows and a potential trigger for the next major oil price surge.