The world is now witnessing a sharp change with the US dollar being sidestepped and overshadowed by local currencies. The majority of the countries are now strengthening their commitment to local currencies, powering local trade routes to evade US sanctions, to the point of ditching them completely. Many nations are using alternatives to the USD to make foreign trade deals, a phenomenon that could end up hurting the dollar in the long run.

Also Read: BRICS Moves to Local Currency Trading: BRICS Currency Dead?

Local Currencies Like Yuan in Global Energy Trade Are Taking Precedence

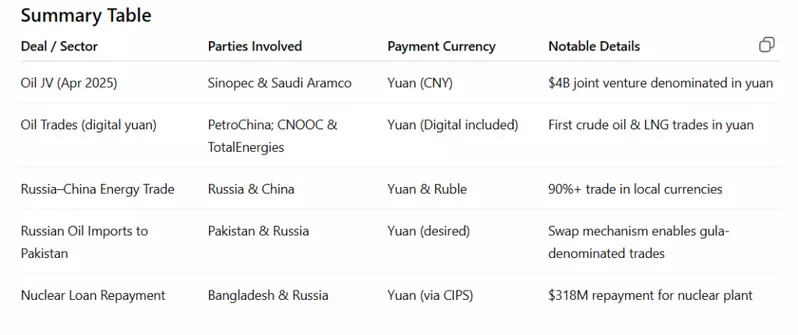

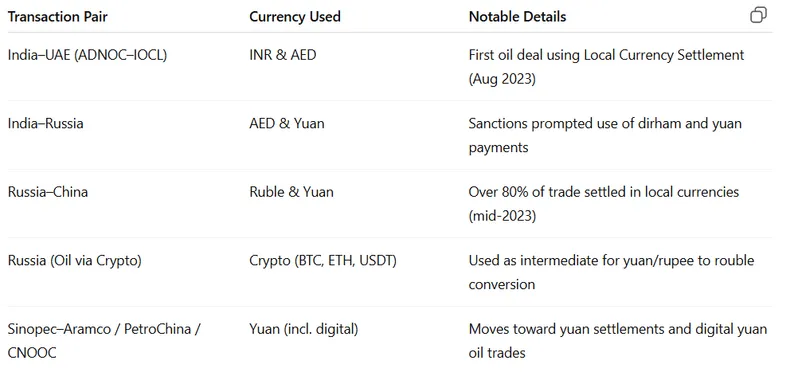

India and Russia have lately been engaging in a local currency narrative, involving the yuan in the majority of their deals. Russia has asked India to pay 10% of its oil payment in yuan, a currency that Russia has long been exploring in depth. As Russia can no longer conduct business in USD, the nation has switched to the Yuan, which continues to benefit the nation in the long run.

Similarly, Bangladesh’s Rooppur power plant construction had also been done in collaboration with Russia. The nation had earlier made active payments in yuan to Russia, making it easier for the nation to trade and transact with the world.

In addition to this, Saudi Arabia is also exploring accepting yuan for oil sales, which again is a striking development to take note of.

The World Goes Local

Apart from Russia, the majority of the nations are inclined to do business in local currencies. Thee nations are also busy building infrastructure to promote the aforementioned narrative.

India has opened Vostro accounts, enabling local currency trade with selected nations. In 2022, 20+ banks opened their accounts with India under Vostro, marking a new change in the global financial regime. Moreover, the nation is vying hard for a local currency narrative to bypass tariffs laid by the US on India.

“Ninety percent of bilateral trade between India and Russia is taking place in local currencies. And both countries have set a bilateral trade target of USD 100 billion by 2030.” The diplomatist later shared

Moreover, BRICS nations have long expressed their desire to free themselves from the US dollar hegemony. The bloc is reportedly busy launching a BRICS currency, the one that rivals the US dollar on a global level.

Also Read: De-Dollarization: 2 Nations Pay 60% Trade in Local Currency, Ditch USD