Nvidia’s stock (NVDA) opened Wednesday’s trading session at $181 after being down 2% in five days. NVDA has been well below the $200 mark for a month, allowing traders to accumulate the asset. It is the most sought-after equity in the market, receiving huge demand from retail investors and institutional funds.

Five years from now, Nvidia stock could be in a better position, rewarding investors for buying the dips. The latest forecast from Traders Union is clear: investors could make massive profits in NVDA by 2030. In this article, we will highlight how high NVDA can reach in the next five years.

Also Read: Netflix Stock Drops as Tax Dispute in Brazil Weighs on Earnings

5 Years From Now, Nvidia Stock (NVDA) Would Deliver This Much Profit

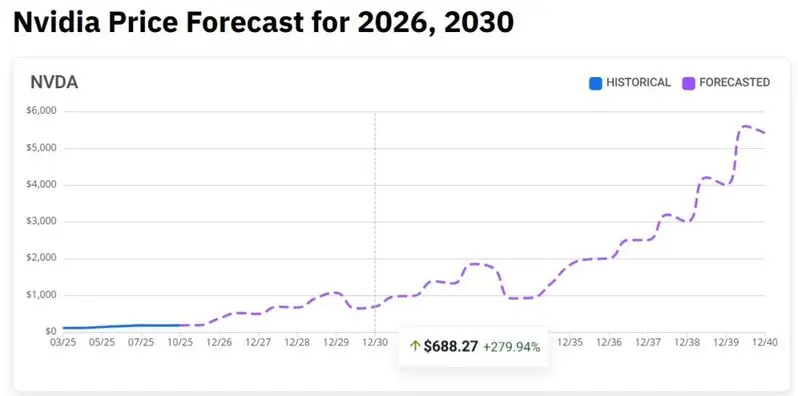

Traders Union has projected Nvidia stock to reach a high of $688 in the next five years. That’s an uptick and return on investment (ROI) of approximately 280% by 2030. Therefore, an investment of $1,000 could turn into $3,800 by the end of the decade. That’s phenomenal returns, as not every financial asset can triple an investor’s money.

Also Read: AMD Stock Gets Forecast Hike From Bank of America, Cites 11/11

The forecast seems realistic as Nvidia stock has spiked more than 1,200% in the last five years. NVDA made investors’ portfolios swell and contained an aura of Midas touch. Therefore, the leading GPU manufacturer remains in high demand as investors don’t want to miss out on the bull run.

In addition, leading global bank HSBC recently revised its price target for Nvidia stock with a bullish projection. The bank wrote in a note to clients that the GPU manufacturer could see its stock climb to $320. That’s even bigger than the Traders Union price prediction.

In conclusion, taking an entry position in NVDA could prove beneficial as several institutional firms are bullish on the stock. The best way to make money is to accumulate the dips or indulge in dollar cost averaging (DCA).