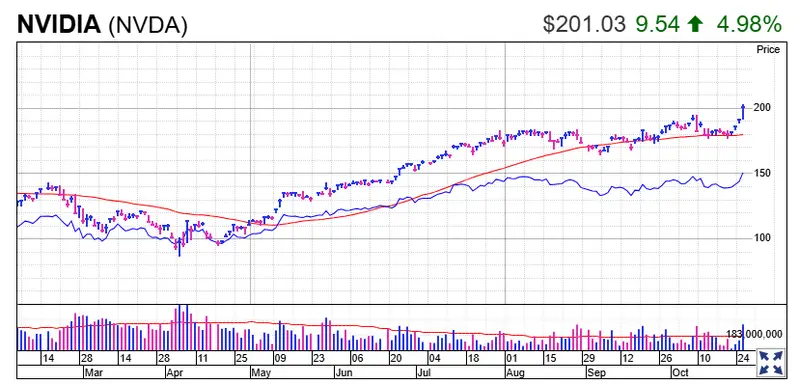

Nvidia stock closed at $201.03 on Tuesday, and the 5% surge pushed the AI chipmaker’s market capitalization to $4.89 trillion—positioning it to actually become the first company in history to breach the $5 trillion threshold. The rally followed CEO Jensen Huang’s keynote at the company’s GTC conference in Washington, D.C., where he unveiled U.S. manufacturing expansions along with strategic partnerships. At the time of writing, Nvidia stock hit an intraday high of $203.15 as investors absorbed announcements spanning telecommunications, autonomous vehicles, and even government contracts that signal strong momentum for the Nvidia stock price.

Also Read: Nvidia (NVDA) announces partnership with Palantir (PLTR)

AI Growth, U.S. Expansion, and Strategic Deals Power Nvidia Stock

Manufacturing Push Drives Nvidia Market Cap Growth

The Nvidia market cap surge came as Huang announced that Blackwell AI processors are now being produced in Arizona facilities, with major construction projects also underway in Texas and Virginia. The move was framed around national security concerns and economic growth, and Huang made it clear that this manufacturing push responds directly to priorities set by President Trump.

Huang stated during his keynote:

“The first thing that President Trump asked me for is bring manufacturing back. Bring manufacturing back because it’s necessary for national security. Bring manufacturing back because we want the jobs. We want that part of the economy.”

He also declared:

“The age of U.S. reindustrialization is here.”

Nvidia chose Washington, D.C. as the conference location deliberately—Huang has become a central figure in Trump’s push for the U.S. to dominate AI, and organizers even gave congressional officials special access to his speech. At this current moment, Huang will meet with Trump in South Korea when he is paying a visit to the region of Asia-Pacific Economic Cooperation Summit.

Barclays analyst Tom OMalley reinforced his purchase rating on Nvidia shares with a price target of $240. O’Malley pointed out that the commentary regarding shipping 3 million Blackwell chips may indicate that this company will exceed its expectations in the coming quarter of October, approximating of $43.5 billion in Blackwell revenue compared to its previous forecasts of 40.9.

Strategic Partnerships Expand Nvidia Stock Appeal

The Nvidia partnerships announced Tuesday include a $1 billion investment in Nokia to develop 6G wireless and mobile AI technology, giving Nvidia a 2.9% stake in the telecommunications giant. Huang emphasized the national security implications of this collaboration, stating about wireless technology:

“Wireless technology around the world, largely today, is deployed on foreign technologies … that has to stop, and we have an opportunity to do that, especially during this fundamental platform shift to 6G.”

He added:

“We’re going through a platform shift. That platform shift should be the once in a lifetime opportunity for us to get back into the game. For us to start innovating with American technology.”

Nvidia stock price benefits from partnerships with Uber for 100,000 autonomous vehicles starting in 2027, along with alliances with CrowdStrike and Palantir for AI security. Seven new supercomputers are being built with the U.S. Department of Energy, including one utilizing 10,000 Blackwell GPUs. Eli Lilly purchased 1,000 GPUs as pharmaceutical companies accelerate AI-driven drug development timelines.

Revenue Projections and Market Position

Huang projected $500 billion in GPU sales through the end of 2026, with demand for the company’s GPUs remaining high after shipping 6 million Blackwell GPUs in the last four quarters. The Nvidia stock today has climbed more than 50% year to date and actually doubled since April lows, driven by insatiable demand as cloud providers including Amazon, Google, and Microsoft construct massive AI data centers worldwide.

Also Read: Don’t Bet Against Amazon: Expert Sees 35% Rally Ahead to $306

Competition is intensifying as AMD secured deals with OpenAI and Oracle, while Qualcomm enters the AI data center market with its own accelerator chips. A potential U.S.-China trade deal could reopen the Chinese market for Nvidia stock after Huang said earlier this month that Nvidia is currently “100% out of China” and has no market share there. The company has also invested up to $100 billion in OpenAI, which is simultaneously one of its most important customers—a relationship that positions Nvidia stock at both ends of the AI value chain as infrastructure buildout accelerates globally.