Nvidia, the leading manufacturer of graphics chips, will publish its Q2 earnings results on Wednesday. The tech giant beat analysts’ expectations by 1.8% last quarter, reporting revenues of $44.06 billion. The revenues were up a staggering 69.2% year-on-year, indicating that the company is on the right track. Analysts now predict significant improvement for the Q2 revenue call, raising the prospects of Nvidia stock (NVDA). The company has a history of exceeding Wall Street expectations, and this time could be no different.

Also Read: SoFi Technology (SOFI): Could Rate Cut Send Stock Surging?

This quarter, analysts expect a revenue growth of 54.6% year-on-year, reaching $46.45 billion, a surge of $2.39 billion from Q1. The majority of analysts have recommended taking an entry position in Nvidia stock to ride the bullish wave. Nvidia closed Monday’s session at $179 after the stock surged close to 2% in the day’s trade. The tech giant has mostly remained sideways this month with little to no price action. The tariffs and trade wars dented its prospects, along with stiff competition from China.

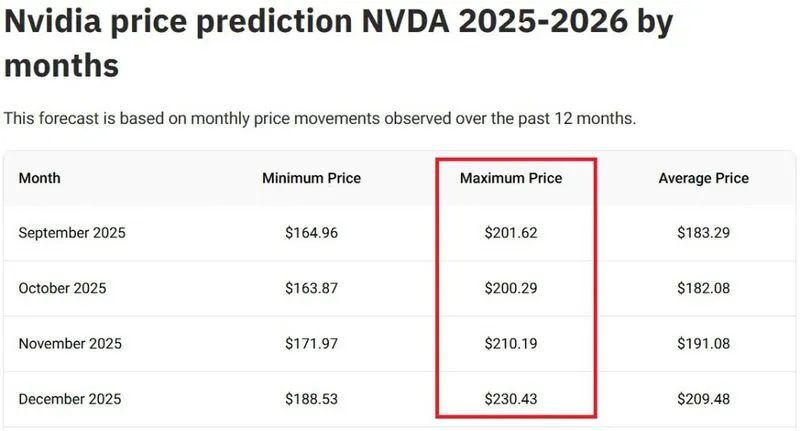

Buy Nvidia Stock at $179: Sell Target Between $200 to $230

Leading stock market price prediction firm Traders Union projects Nvidia’s Q2 returns could beat expectations, making NVDA surge in value. The stock market brokering firm has given a buy call for NVDA, recommending investors to take an entry position at $179. Accumulating the stock below the $200 mark could be beneficial as it’s available at a discount due to market conditions.

Also Read: Nvidia Launches Blackwell-Powered Jetson Thor Kit: NVDA Climbs

The latest and revised price prediction for Nvidia stock stands at a maximum price of $200, $210, and $230. Buying NVDA at $179 before the Q2 earnings call would be the best choice for an entry position. If NVDA reaches $200, $210, and $230, it would surge 12%, 17%, and 28%, respectively. Therefore, an investment of $1,000 could turn into $1,120, $1,170, and $1,280, based on the sell order.