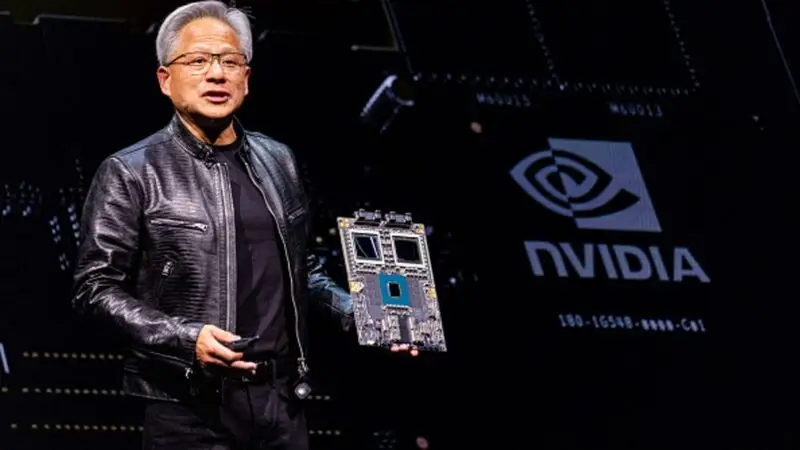

In what was a rather important development for the stock market, Nvidia (NVDA) has officially surpassed Apple (AAPL) in market cap, but what role did new US President Trump play in the shifting tide? Indeed, the move saw the AI chipmaker officially become the largest company by market cap.

The total market value of Nvidia had officially reached $3.448 trillion to just marginally usurp the iPhone developer. However, an interesting note of the development is what the 47th president did to push the tech stock to overall dominance. Moreover, what does it mean for the stock this coming year?

Also Read: Nvidia, Amazon Lead Magnificent 7 Stocks to Watch in January

Nvidia Passes Apple, With a Little Help From Trump

Entering 2025, Nvidia and Apple were set for a notable face-off. Indeed, both companies had eyes on a monumental record that was within reach this year. Specifically, the technology firms looked poised to duke it out to be the first company to reach $4 trillion in market cap.

Although it was feasible for the iPhone maker, Nvidia had one key hurdle it had to make. That has officially come to fruition today. Indeed, Nvidia has officially surpassed Apple to be the largest company by market cap, with a little help from returning US President Donald Trump.

Also Read: Citi Gives Apple Stock Buy Rating: Can AAPL Hit $300 in 2025?

Trump had indicated that AI would be a key aspect of his returning administration. That proved to be great for the chipmaker, as they have been thriving from the ongoing artificial intelligence demand surge. That continued Wednesday, with NVDA stock growing more than 4.3%.

However, that isn’t all Trump did. The 47th president signed a multibillion-dollar AI infrastructure plan with Oracle, OpenAI, and SoftBank. called Stargate, it would begin with a data center in Texas and $500 billion in investments over the next four years.

With Nvidia still at the center of all AI development, its importance was once again reinforced. Additionally, the move looks to give more credence to the idea that it could be the first company to reach a $ 4 trillion cap and repeat its dominant 2024 Wall Street performance.