The US stock market has continued its ongoing theme of increased volatility throughout this week. After staging a bounceback to start, things took a turn downward on Wednesday. However, that may not stay that way for long. Amid increased uncertainty, Nvidia (NVDA) has become the key Magnificent 7 stock to watch in May ahead of its Q1 earnings report.

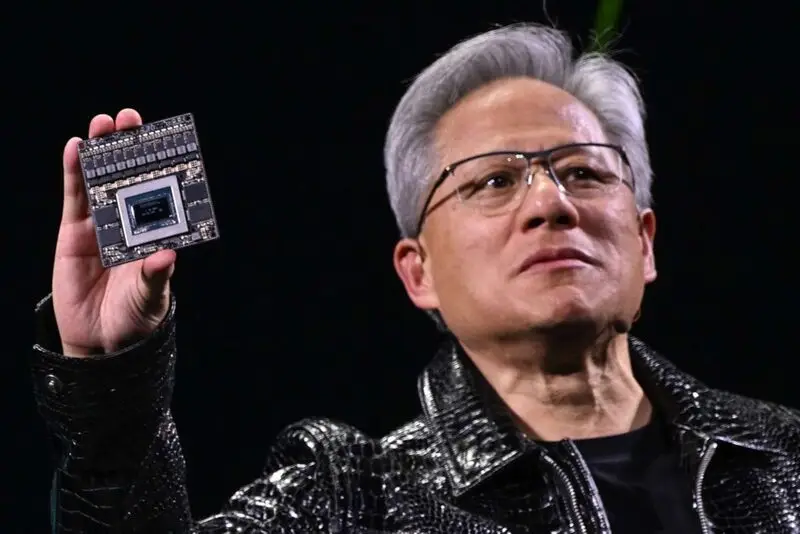

The AI chipmaker has been one of the most talked-about companies on Wall Street for much of the year. With tariffs and geopolitical tensions set to impact its operations, all eyes will be fixed on how it responds. Moreover, its Q1 data could have massive ramifications on where it goes from here.

Also Read: Kraken to Offer Tokenized Stocks for Apple, Tesla, & Nvidia

Nvidia is the Top Mag 7 Stock to Watch in May With Critical Earnings Nearing

The midpoint of the week proved to be a tough one for the US stock market. Not only did the market itself drop, but so too did the US dollar and bonds. Indeed, the Dow Jones looked to turn things around after an 800-point decline amid increased concerns from a macroeconomic perspective.

That hasn’t derailed hope for one of the biggest companies in the world, however. Nvidia (NVDA) remains the top Magnificent 7 stock to watch in May as its Q1 earnings report is fast approaching. Indeed, the data is set to be unveiled in just seven days, with all eyes on the outcome.

Also Read: Nvidia (NVDA) CEO Unveils Key Expansion as Stock Stalls Toward $150

Company expectations still sit at $43 billion, while Zack’s Consensus Estimates sit at $42.7 billion, up 64% from this time a year ago. Additionally, estimates project an increase of more than 42% in earnings per share for the chipmaker despite its struggles this year.

The company bounced back from a 1.9% decline on Wednesday to jump 1% on Thursday as it trades at the $133 mark. Moreover, it remains above the 200-day line that supports a potentially bullish move to come for the stock before the month ends. Indeed, all eyes will be on how the imminent earnings data impacts the stock, especially with so much uncertainty surrounding market conditions.