Nvidia is currently basking in the bullish momentum as it prepares to launch its brand-new Blackwell chip. The firm is all set to unveil a brand new chip domain, dubbed Blackwell, which is already in demand before its launch, prompting the firm to encounter a surge in demand, which could catapult NVDA price to new highs.

Also Read: Top 3 Cryptocurrencies That Could Rally Over 100% In December

Blackwell Chip: Can It Help Nvidia Soar?

The launch of Blackwell chips by Nvidia is significant in many ways. For instance, the Blackwell chips are full of innovative elements and components that could transform the next phase of the tech market. Blackwell chips have been touted as Nvidia’s next-best innovation primarily due to their secure AI computing architecture. The element protects data from unauthorized access, taking the AI security prompts to new levels.

“Blackwell includes NVIDIA Confidential Computing, which protects sensitive data and AI models from unauthorized access with strong hardware-based security. Enterprises can now secure even the largest models in a performant way, in addition to protecting AI intellectual property (IP) and securely enabling confidential AI training, inference, and federated learning.”

The firm has already started to send its primary Blackwell-backed GPUs to major market contenders, including Microsoft. At the same time, Nvidia shared in its fiscal third quarter 2025 earnings call (November 20) how Blackwell has been sent to all major industry contenders to try and tinker with the tech.

“Blackwell is now in the hands of all of our major partners, and they are working to bring up their data centers. We are integrating Blackwell systems into the diverse data center configurations of our customers.”

Also Read: Jio Shares Rise 2.5% Today: Gets Buy Call With New Target of 355

The AI Stock Surged 170% In 2024: What About 2025?

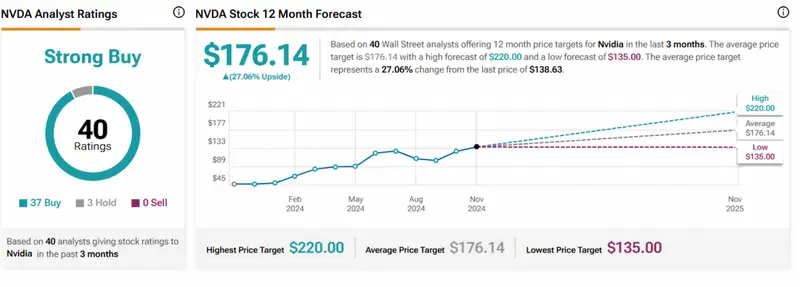

Nvidia has scored major gains this year, with the firm raking in nearly 170% gains this year. Per Barchart, Nvidia may very well aim for a $220 stock price, which will prompt the firm to hit the $5 trillion market cap. The Bank of America expects Nvidia to rise above $300 billion by the end of this decade.

In addition to this, per TipRanks, Nvidia is eyeing a high price target of $220, which it may very well achieve in the next 12 months.

“The average price target for Nvidia is $176.14. This is based on 40 Wall Street analysts 12-month price targets, issued in the past 3 months. The highest analyst price target is $220.00; the lowest forecast is $135.00. The average price target represents a 27.06% increase from the current price of $138.63. Nvidia’s analyst rating consensus is a strong buy. This is based on the ratings of 40 Wall Street analysts.”

Also Read: Amazon Stock (AMZN) Outpaces Dow: Surges 20% in 3 Months