Nvidia (NVDA) stock is suffering from its worst dropoff in months, as shares have fallen over 5% during Tuesday’s trading session. The chipmaking leader held its Blackwell chip launch event on Monday, which prior to launch brought plenty of investor interest and stock momentum. However, on the day following the unveiling, Nvidia’s stock is performing at its worst rate in almost a year.

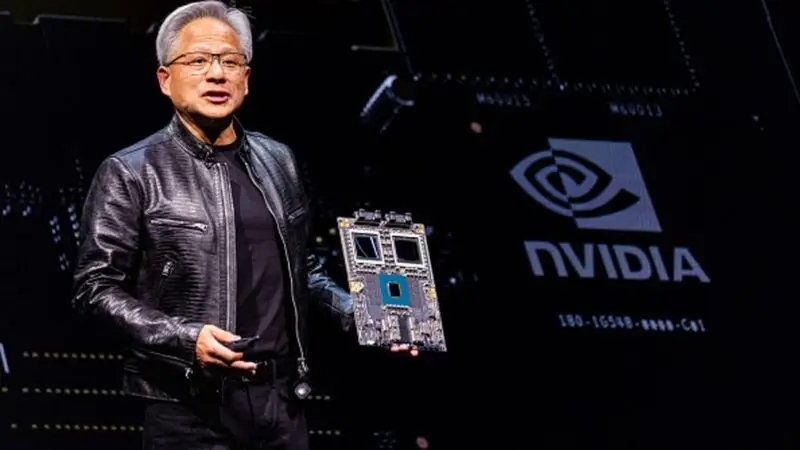

Part of that could reflect investors “selling the news” of the event, which brought announcements around a personal supercomputer running a new Blackwell chip as well as a partnership involving driverless truck technology. Investors were clearly expecting more from CEO Jensen Huang at the event. While stock went up over 3% immediately after the event, shares have since fallen.

“While Jensen Huang, as expected, delivered a broad master class on the current state and direction of the [artificial-intelligence] industry, and made several technically interesting announcements that together further extend the company’s hardware and software industry leadership, we believe many investors were hoping for more concrete progress updates on the ramp of Blackwell and some input as to the company’s progress with its next-generation GPU platform, Rubin,” Benchmark Research analyst Cody Acree wrote in a note to Wall Street clients. His analysis, as well as others’ are triggering a sharp drop in Nvidia’s stock to start 2025.

Another Wall Street analyst, Stifel analyst Ruben Roy, noted that Huang’s announcements were “significant, but long-tailed (i.e. minimal impact to model).”“We view these developments as further deepening the company’s competitive moat and positioning around potentially multi-billion dollar advancements tied to AI agents, robotics, autonomous vehicles, graphics, and PC and edge-device inferences in the coming years,” he said in a report.

Nvidia Stock Suffers on Tuesday

Nvidia stock is down 5% in midday trading Tuesday, heading for its worst one-day percentage drop since a 9.5% decline seen Sept. 3, 2024. The stock is one of the S&P 500’s worst performers of the day so far. Its performance assisted an over 40-point drop for that index on Tuesday.

On the other hand, Asian chip stocks rose sharply after the RTX Blackwell news hit markets worldwide. “There’s been some great AI-supportive newsflow to start the year,” said Andrew Jackson from Ortus Advisors Pte. Major suppliers Tokyo Electron and Advantest saw their stock jump over 6% in one day. The new chip technology pushed other companies up, too, with Hon Hai Precision growing by 4.1%. These gains show strong market faith in Nvidia stock potential. In the US however, investors in Nvidia stock clearly want more.

Also Read: Microsoft Plans $80B AI Investment: What it Means for MSFT Stock

In 2024, Nvidia was one of the top performers on the entire US stock market. It outperformed just about every magnificent-7 stock rival in the calendar year, surging over 170%. So far in 2025 though, despite being a fan favorite, NVDA stock is underperforming.