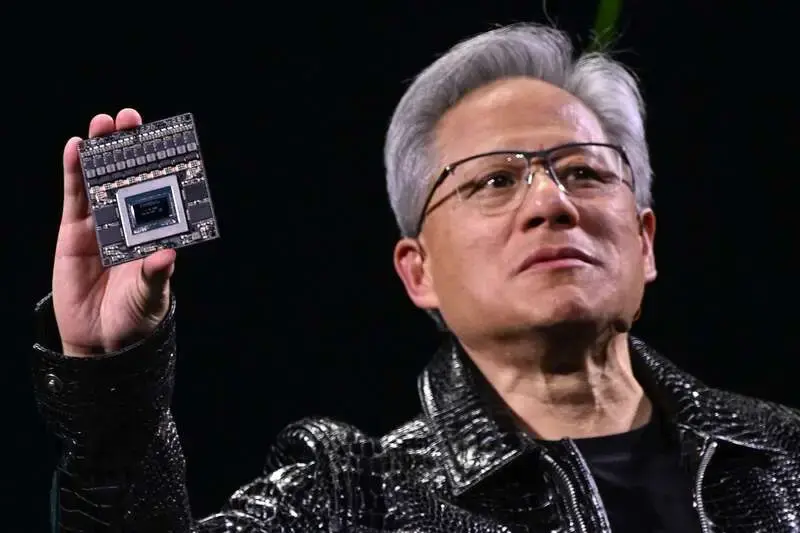

Nvidia (NVDA) and Meta (META) announced an expanded multiyear, multigenerational partnership for graphics processing units (GPUs). The deal will see Nvidia provide the social media giant with millions of its Blackwell and Rubin GPUs. Shares in Nvidia stock rose higher on Wednesday after the deal was announced before trading opened.

NVDA is up 2.7% to $189 at press time. “No one deploys AI at Meta’s scale — integrating frontier research with industrial-scale infrastructure to power the world’s largest personalization and recommendation systems for billions of users,” Nvidia CEO Jensen Huang said in a statement.

A precise dollar amount value for the deal remains undisclosed; however, Nvidia stated that Meta will roll out the chips in its own data centers and lean on those available via Nvidia Cloud Partners. NVIDIA’s Cloud Partner program includes companies like CoreWeave (CRWV) and Crusoe, which host NVIDIA chips for other companies to rent and use.

Also Read: Trump-Backed WLFI Rises 16% In 1 Day: Mar-a-Lago Event Hype?

Nvidia Stock Forecast Hikes

Furthermore, Nvidia (NVDA) stock is seeing upward revisions on Wall Street, indicating optimism among financial firms and experts. Citigroup, the global banking giant valued at $210 billion, recently upgraded its price target on Nvidia. Citi wrote in a note to clients to add positions in NVDA before the second half of 2026. The analysis explains that the stock could outperform expectations during the last half of the year. Citigroup placed a new price target of $270 for Nvidia stock, noting that the AI infrastructure and revenue visibility will extend and begin to improve in 2027.

Citi analyst Atif Malik, along with his team, wrote that they expect the company’s January-quarter revenue to reach $67 billion. This is above the market expectations of $65.6 billion, which could lead to a surge in value for Nvidia stock. The note also read that the April-quarter sales could also beat expectations and reach $73 billion, above the expectations of $71.6 billion.