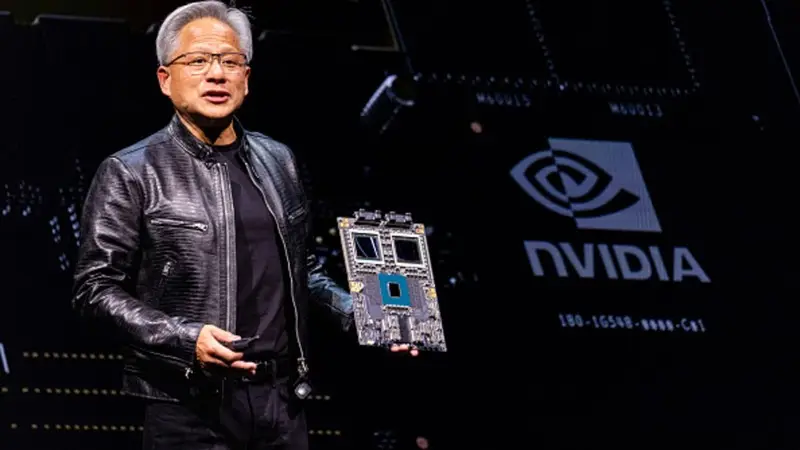

After increasing its value by almost 200% this year, Nvidia (NVDA) is reportedly looking to acquire an AI startup as it looks to be the first company to reach a $4 trillion market cap. Indeed, the chipmaker is looking to acquire Run:ai for $700 million in a move that was first reported in April.

The company is currently navigating some regulatory concerns surrounding the acquisition, however. Specifically, the firm is seeking EU antitrust clearance to approve the purchase, according to a Reuters report. The approval will be necessary due to the fact that the move would “threaten competition in the markets where the companies operate,” the European Commission said this week.

Also Read: Nvidia Price Prediction: Here’s When NVDA May Hit $300

Nvidia Going After Approval to Acquire AI Startup

The last two years have seen AI dominate the tech sector. Specifically, Wall Street’s information technology sector has seen artificial intelligence-related products skyrocket. That has led several companies to invest heavily in emerging tech, looking to take on a bit of the market.

Yet, no company has benefitted in the way that one emerging firm has, and it could be looking to increase its foothold. Indeed, Nvidia is reportedly seeking regulatory approval to acquire an AI startup as the race to a $4 trillion market cap commences.

Also Read: NVIDIA (NVDA) Stock Surges Amid Mumbai Drugmaker AI Chip Controversy

There are a few companies that are all looking at the $4 trillion number as an attainable goal. Among them, Apple (APPL) has emerged as the most likely. The company became the first to reach a $2 trillion and $3 trillion market cap and looks to continue that trend.

Yet, there is no counting out Microsoft (MSFT). Some experts believe that it could outperform both Apple and Nvidia in the coming years due to its diversification and foothold in cloud-based computing. However, if the AI boom continues and Nvidia does acquire the aforementioned Run:ai, they could make it all the more interesting. Indeed, it could become the clear leader in the stock market’s leading technology.