There is no denying that the US stock market has been caught in a volatile state over the last several weeks. With geopolitical tensions rising, there is increased concern about how economic fragility will impact Wall Street. That has pushed Nvidia (NVDA) down 30% from its 2024 high, but the stock may actually be better than it seems.

A big reason for the downturn has been the US Liberation Day tariff policy from President Donald Trump. BlackRock’s CEO, Larry Fink, called the plan one of the worst in his 49 years in finance. Subsequently, if a resolution is found regarding the sweeping economic policy, the AI chipmaker could be among the best to benefit.

Also Read: Nvidia (NVDA) Retakes $114: Why Is Stock Surging Today?

Nvidia Drops Amid Horrid 2025 Market While The Company Still Looks Strong

Amid a potential US recession, the stock market has been increasingly volatile. At this point in the year, uncertainty is the prevailing theme. Moreover, Nvidia is no exception. The stock jumped more than 3% on Friday but is still down more than 18% over the last 16 months.

Despite the increasing geopolitical and economic concerns, there are reasons for hope regarding the stock that jumped 174% last year. Indeed, with Nvidia (NVDA) down 30% from its 2024 high, the stock may be better than it seems for investors.

Also Read: Nvidia (NVDA): Can Tariff Pause Push Stock to $200

There is reason to believe economic headwinds are a major player in its recent decline. That being said, the key silver lining is that they are likely to be sorted out sooner rather than later. Countries like India and the European Union have all sought new trade deals with the US. Although the Chinese trade war concerns still stand, there is progress to move past the deal nonetheless.

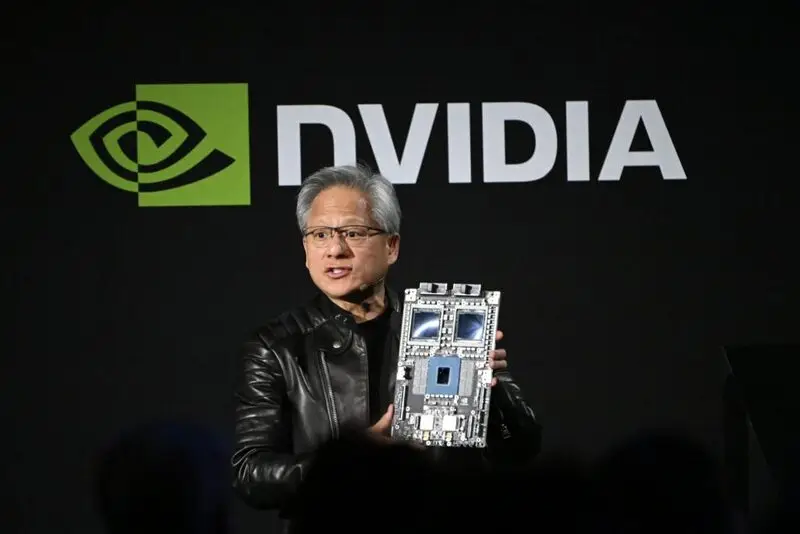

When things do move forward, the progression of the tech industry is expected. Moreover, that is bound to help Nvidia in the long term. The company’s CEO, Jensen Huang, recently projected that spending in the data center industry could jump to $2 trillion over the next five years.

That is already beginning, with companies like Amazon (AMZN), Meta Platforms (META), Alphabet (GOOGL), and Microsoft (MSFT) spending $320 billion this year. With Nvidia processors accounting for between 70% and 95% of all AI processors, the company should boom when this spending starts paying off in the coming years.